Summary

- Retail used and CPO vehicles are seeing surges in sales numbers due to tumbling prices

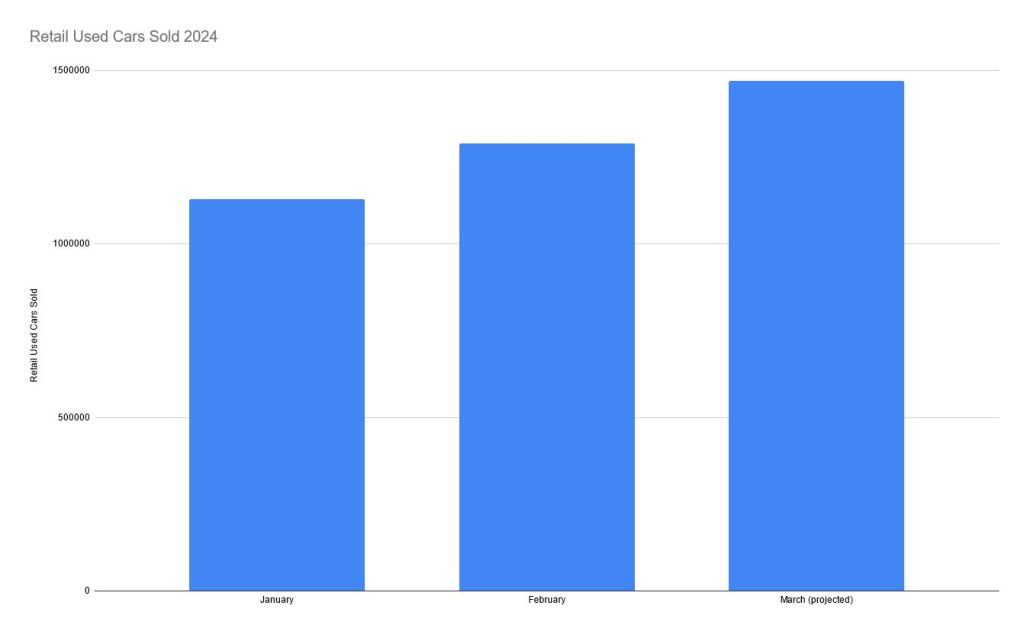

- 1.13 million used vehicles were moved via dealerships and retail used lots in January, with 1.29 million used vehicles moving in February

- The trend towards used vehicles has created a cyclical effect where dealerships are offering more for used vehicles to entice consumers to sell

- CPO vehicles from short term leases are also creating a strong market, especially for those looking for “new” cars with partial or extended warranties

- We think that the effect of pricing dynamics and trends in the used market is a win/win for the consumer

- We also think that this is why traditional advertisements for major brands have included many more used vehicles in recent months over new cars

The automotive industry is witnessing a notable surge in the sales of used cars and certified pre-owned (CPO) vehicles across the first two months of 2024, a somewhat surprising trend in a time of the year when purchasing behavior is usually aimed towards new vehicles.

This surge, primarily attributed to falling prices in the used car market, has led to a widening price gap between new and used vehicles. This, in turn, has significantly influenced purchasing behavior across almost all types of vehicles, from compact to full size SUVs and heavy duty trucks.

We should clarify that this trend is regarding retail used vehicles, such as from specialist used car lots and dealership used inventory, and does not take into account the private used market.

New Car Prices Rising VS Retail Used Market Prices Falling

February emerged as a pivotal month for the used market, with dealers experiencing a substantial increase in sales to an impressive 1.29 million units. Comparatively, January saw 1.13 million units moved, meaning February saw a 14.2% increase in overall used sales.

Notably, this figure represents the highest sales volume on record since August 2021, a sure indicator of robust market activity. Projections suggest a further increase in sales volume for March, if there is sustained momentum in the market and heightened consumer interest in used vehicles.

The surge in sales has resulted in a decline in used vehicle inventory levels, which stood at 1.89 million units in February 2024. While this decline signals improved inventory turnover, the key item to note is that inventory levels remain significantly higher than those recorded in February 2023, which stood at 1.34 million units.

Furthermore, the turn rate witnessed a substantial increase from 57% in January to 71% in February. This means that there is greater efficiency in inventory vehicle turnover, to the point that many used lots are having mild issues in keeping enough vehicles in stock, which has a knock-on effect to increased prices offered to purchase used vehicles

This cyclical effect is what is helping drive retail used prices down, as used lots still need to maintain some profit and need inventory to sell to garner said profits.

2024 Pricing Dynamics & Trends

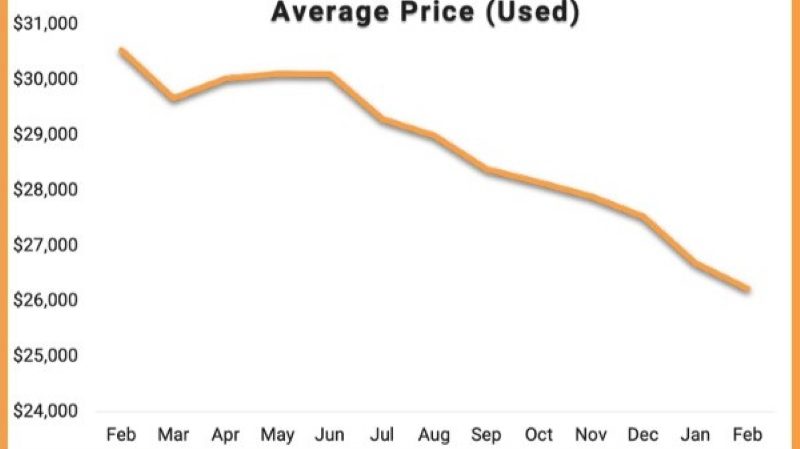

Pricing dynamics are playing a pivotal role in shaping the used car market, with prices experiencing a downward trajectory for the eighth consecutive month. The average list price of a used vehicle has plummeted by over $3,800 from $30,000 in June 2023 to slightly above $26,000 in February 2024.

In contrast, the average price of new cars dipped below $50,000 for the first time in over a year, albeit at a much slower rate compared to used cars. This widening gap between new and used vehicle prices has prompted consumers to heavily investigate their purchasing options, potentially favoring the more affordable used car market.

This is especially important due to many cars on the retail used market being under or around 5 years old, meaning that many still carry a portion of their manufacturer warranty.

The downward trend in the retail used car market is also reflected in the smaller CPO sales segment, which are used vehicles that were bought on leases instead of financing, so they are guaranteed to be under certain mileage rates. Much like the retail used car market, this segment experienced a significant surge in sales volume during February.

Sales rebounded to 163,000 units, marking a recovery from a sluggish performance in the fourth quarter of 2023. Inventory levels dipped below 200,000 units for the first time in five months, accompanied by a rapid uptick in turn rate to 86%, the highest level since March 2023.

This resurgence in the CPO segment underscores the value that the CPO and retail used markets are both offering for today’s much more price aware consumer.

Consider Buying a Car Out of State

Why the Used Market Is The Place To Buy “New” Now

Similar to the broader used car market, certified prices have witnessed a rapid decline, decreasing by more than $3,000 on average since May 2023. In February, the average price of CPO vehicles stood at about $37,000, making them an attractive option for budget-conscious consumers seeking pre-owned vehicles with valued-added inclusions such as “new” warranties.

This decline in CPO vehicle prices outpaced the decrease observed in new car prices, further accentuating the price disparity between new and CPO vehicles. This is also why short-term 3 or 4 year leases have been seeing a rise in the new car market, as many consumers are waiting for CPO listings to buy “new” cars, and many others are seeking retail used options for “gently used” cars.

We think that the surge in sales of used cars and CPO vehicles during February 2024 underscores the impact of pricing dynamics on consumer behavior and market trends. We also think that this has been having an effect on how dealerships and retail used lots have been advertising their offerings, turning away from newer cars and focusing on the used market following observed industry trends.

This trend shows no sign of slowing down, so if you’re in the market for a new car, right now might be the perfect time to look at the CPO and used vehicle market to get that “new” car instead, at significant savings.