With sales data for the first five months of 2013 in the bag, we know that America’s appetite for pickup trucks has grown 14.5% compared with the same period in 2012. This far outpaces the industry’s growth. Total new vehicle sales are up 7.2%.

The Ranger and Dakota have died off, and sales of the Colorado, Canyon, and Equator totalled just 4139 this year.

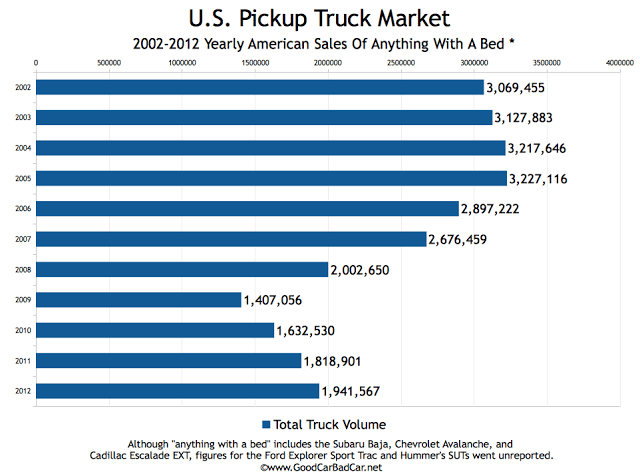

The year’s not over, by any means. We don’t even get numbers for 2013’s halfway point until Tuesday, July 2. However, today seemed like as good a time as any to build a few charts which show the size of the truck market over the last decade. (We threw in 2002 for good measure.) Much has been said, both here at GCBC and elsewhere, about the fast-growing truck market.

But it’s important to keep this in historical context, and not just in the context provided by the most recent history. Truck sales are growing, but they do not account for nearly as much of the industry’s volume as they did even in 2011, let alone 2005.

In part, this is a result of a mass departure of truck nameplates. It also reflects the growing acceptance of crossovers and small cars as appropriate family vehicles. Perhaps that desire isn’t growing fast – the subcompact boom has slowed – but in comparison with 2004, times have most definitely changed.

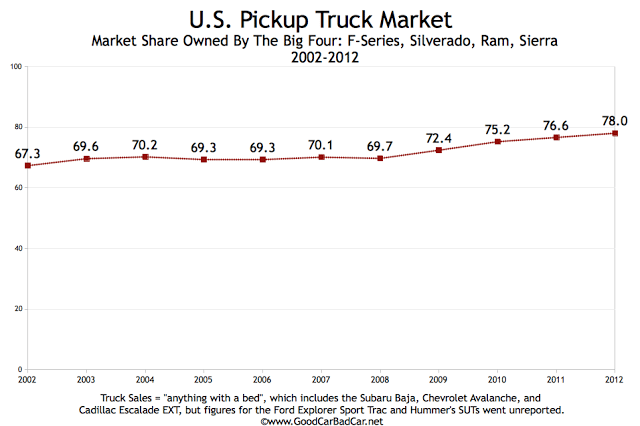

Ford F-Series sales are up 22% this year. It accounts for 34.3% of America’s truck market, up from 30.6% in 2002, when F-Series sales nearly hit 940,000 units, a couple hundred thousand more than Ford will likely sell this year. In 2002, even when overall new vehicle sales were much higher than they are now, the F-Series collected 5.6% of the industry’s volume. That number is down to 4.7% in 2013.

It’s not just the departure of most smaller trucks that have played a part in the decline of pickup truck sales. The trucks that remain, even the best-selling F-Series, don’t garner the attention they once did.

Finally, you can click the third chart to measure the sway of Detroit’s four main trucks: Ford F-Series, Chevrolet Silverado, GMC Sierra, and Dodge Ram. As a quartet, they own 81.3% of America’s truck market in 2013. How has that number changed over the course of the last eleven years? Rather a lot, I reckon.

Pickups used in the construction of this post: Cadillac Escalade EXT, Chevrolet Avalanche, Chevrolet Colorado, Chevrolet S-10, Chevrolet Silverado, Chevrolet SSR, Dodge Dakota, Dodge Ram, Ford F-Series, Ford Ranger, GMC Canyon, GMC Sierra, GMC Sonoma, Honda Ridgeline, Isuzu i-250/i-350, Isuzu Hombre, Lincoln Blackwood, Lincoln Mark LT, Mazda B-Series, Mitsubishi Raider, Nissan Frontier, Nissan Titan, Subaru Baja, Suzuki Equator, Toyota Tacoma, Toyota Tundra. Sales figures for Ford Explorer Sport Trac and Hummer’s SUTs were rolled into overarching nameplate totals.