Summary

- Up to 2019, used car prices had increased on average 5% per year for many years

- When the global pandemic hit, new car sales plummeted

- Used car sales, however, increased exponentially

- This drove up the price of used cars, especially for those who had career slowdowns and needed/wanted more disposable income during economic uncertainties

- While the market has stabilized for now, we don’t think the prices will start dropping until another polar shift in the segment occurs

While we all desire to have a new car in our driveways, the realistic truth of the world is that used cars are a much, much bigger market. Be it through private sale, auction, or a used car dealership, the number of used cars for sale outnumber new cars somewhere in the range of 10 to 1.

The past few years have witnessed a particularly tumultuous journey in the used car market, however, with prices experiencing unprecedented swings. From the stable grounds of 2019 to the rollercoaster ride of the present, let’s delve into the trends and factors shaping the trajectory of used car prices.

2019 & Before: Stability In Used Car Prices

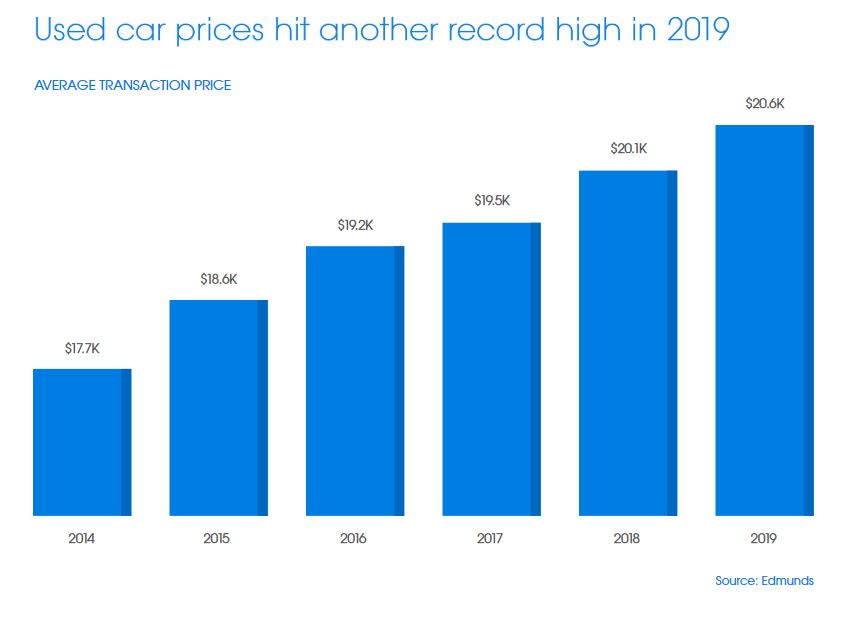

In 2019, the used car market enjoyed relative stability and consistent growth. According to data from the Edmunds Used Vehicle Report, the average used car price in the United States was around $20,000 for the average mid-sized family car, something akin to a large sedan or smaller SUV. Demand for used cars remained strong, fueled by factors such as rising new car prices, economic stability, and a robust job market.

Consumers were drawn to the value proposition offered by “gently used” vehicles, defined as within 2 to 6 years of their original sale. Before 2020, from 2014 to 2019, there was a stable growth trend of about 4.5% to 5% YOY increases in used vehicle prices.

The Global Pandemic Threw the Market Into Disarray

The onset of the COVID-19 pandemic in early 2020 brought about major disruptions to almost every sector of industry, including the automotive industry. With lockdowns, supply chain disruptions, and a sharp downturn in the economy, car sales plummeted, both in the new and used markets.

However, an unexpected trend emerged as the year progressed. As people sought alternatives to public transportation and embraced the concept of personal mobility, demand for used cars surged.

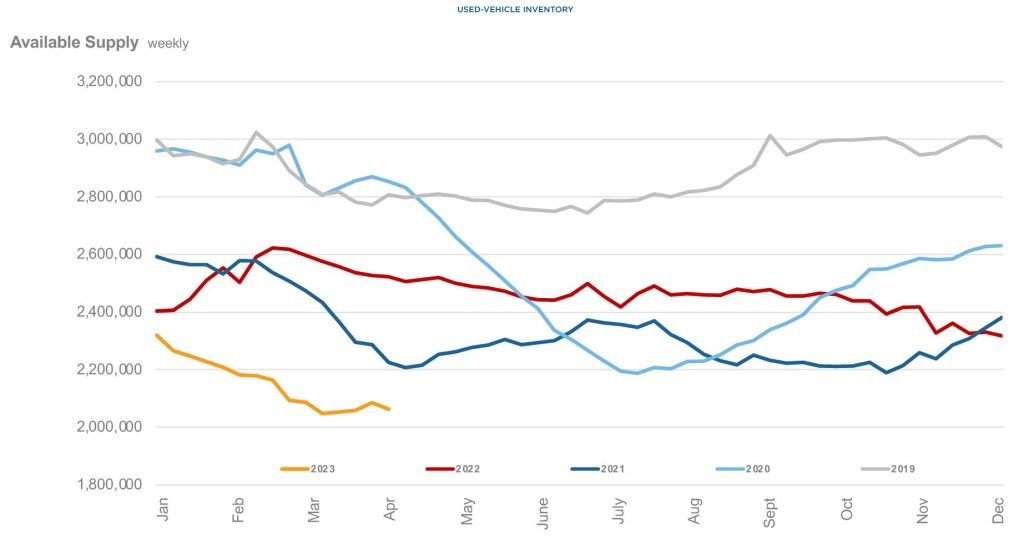

The pandemic-induced shift in consumer wants and needs, coupled with production delays in the new car market, led to a scarcity of new vehicles. This then caused a direct correlation in the used market, as used car sales surged, especially in private sales through websites or local advertisements.

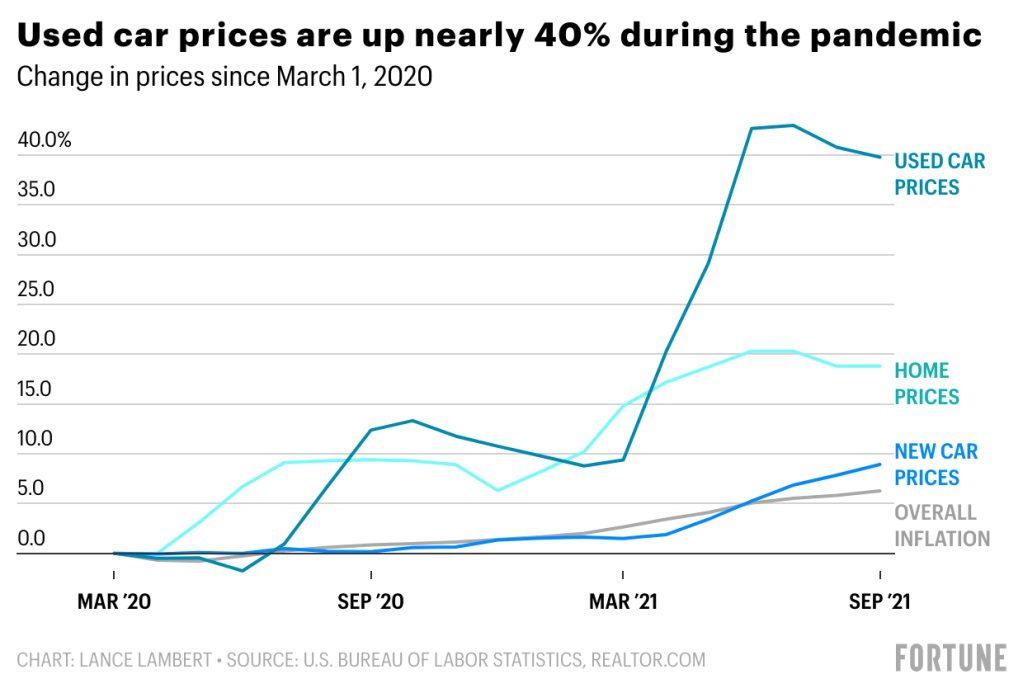

According to a study in 2023 by Cox Automotive, used car prices soared to record highs during this period, with the average transaction price reaching approximately $23,000 by mid-2020. This represented a nearly 15% jump in used prices in just 12 months.

2021: The Supply Crunch Continues

Despite efforts to mitigate the impacts of the pandemic, supply chain challenges persisted into 2021 across almost every industry, especially the computer, semiconductor, and by association automotive sectors. The ripple effects were felt across the entire automotive ecosystem, with used car prices continuing their upward trajectory.

According to that same Cox Automotive study above, the average used car price surged to over $26,000 in 2021, marking another milestone in the market’s evolution. This represented a massive 35% increase over the 2019 prices, with trending data showing that the longer the pandemic lasted, the more prices would go up.

The shortage of new cars not only drove consumers towards the used market, but also affected the availability of certain desired models, which only further drove up prices. Additionally, factors such as increased demand for trucks and SUVs, low interest rates to rekindle the economy, and stimulus payments contributed to the sustained strength of the used car market.

2022: Signs of Stabilization?

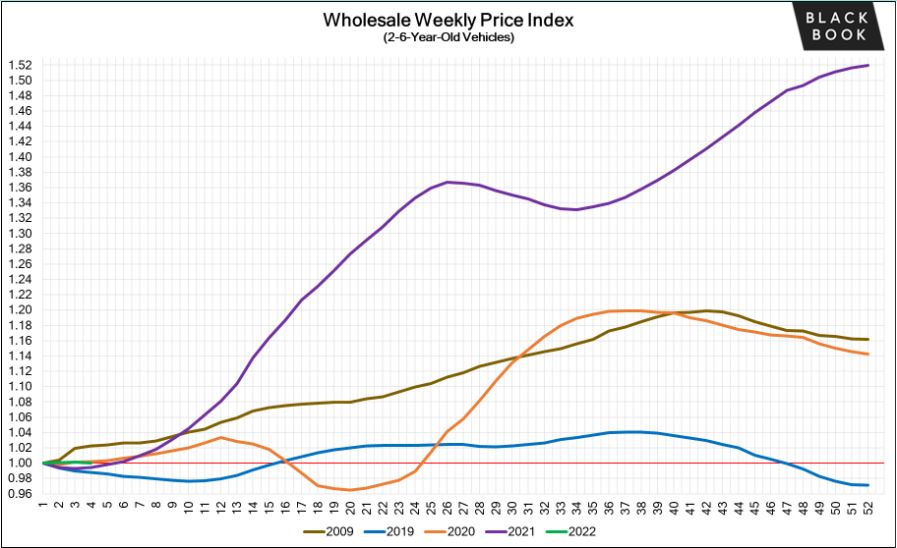

Transitioning into 2022, with the first mass-scale effective vaccines and agents to combat COVID-19 starting to appear, signs of stabilization began to emerge in the used car market. While prices remained elevated compared to pre-pandemic levels, the pace of growth began to taper off. According to analysis by Black Book, the average used car price in the first quarter of 2022 still hovered around $26,000, plus or minus $1,500.

Several factors contributed to this stabilization, with the most important being supply chains catching up to need, leading to the gradual recovery of new car production. Other factors included a shift in consumer preferences as the effects of the pandemic subsided, as well as incentives by dealers and manufacturers to stimulate new car purchases.

Additionally, as more electric vehicles entered the market and manufacturers ramped up production, traditional internal combustion engine vehicles faced increased competition, impacting their resale values.

2023 & Beyond: The New Normal

The journey of used car prices from 2019 to the present has been nothing short of a rollercoaster ride, shaped by unprecedented global events and shifting consumer behaviors. What started as a period of stability in 2019 quickly transformed into a tale of soaring prices driven by the COVID-19 pandemic and its aftermath.

While the market has shown signs of stabilization in recent months, we think that many uncertainties remain, particularly regarding the long-term impacts of the supply chain disruption and the current economic inflation driving prices of everything up. Yet, the fact remains that compared to pre-pandemic prices, we live in a time where the used market is still the primary go-to for consumers. This in turn has kept used prices around the 2022 level, 35 to 40% higher than what an equivalent car would cost used in 2019, and there are few, if any signs that we will see a decrease in used values for the foreseeable future.