A new year is always a nice opportunity to reflect on the past year and in our case, that means looking at which cars have sold surprisingly well China in 2016 and which do we expect to surprise in 2017. We’ll also look at which cars or brands have disappointed from a sales volume point of view in a separate article. Click the following links to check back on last year’s surprises or disappointments. Also find our success stories for 2016 in the US and Europe and our predictions for China in 2017.

1. Domestic crossovers

I’m short of superlatives to describe how sales of domestic brand crossovers in China have exploded in 2016. More than 5 million domestic Chinese crossovers were sold in the first 2016, that’s more than the entire car markets of Germany and Spain combined! In a market up 17%, crossovers and SUVs from Chinese brands increased their sales by 50,6%. In comparison: sales of import brand crossovers increased 29%, faster than the overall market but just over half the growth rate of their domestic rivals. This also means that the share of Chinese brands in the crossover segment grew to 57,4%, much higher than their share of the overall market, which also grew to an all-time high of 37,3%. The share of domestic brand crossovers and SUVs in the overall market grew from 16,3% in 2015 to 21,4% in 2016. The cause of this impressive surge? A flood of hot new models, aimed directly at the needs and desires of the Chinese new car buyer, with prices so low import brands can’t match them and ever-improving design and quality, both exterior and interior, and most equipped with ever-larger infotainment touch screens on top of the center console. No less than 29 new nameplates were introduced in the first 11 months of 2016, of which 3 from all-new brands: Borgward, SWM and Hanteng.

I’m short of superlatives to describe how sales of domestic brand crossovers in China have exploded in 2016. More than 5 million domestic Chinese crossovers were sold in the first 2016, that’s more than the entire car markets of Germany and Spain combined! In a market up 17%, crossovers and SUVs from Chinese brands increased their sales by 50,6%. In comparison: sales of import brand crossovers increased 29%, faster than the overall market but just over half the growth rate of their domestic rivals. This also means that the share of Chinese brands in the crossover segment grew to 57,4%, much higher than their share of the overall market, which also grew to an all-time high of 37,3%. The share of domestic brand crossovers and SUVs in the overall market grew from 16,3% in 2015 to 21,4% in 2016. The cause of this impressive surge? A flood of hot new models, aimed directly at the needs and desires of the Chinese new car buyer, with prices so low import brands can’t match them and ever-improving design and quality, both exterior and interior, and most equipped with ever-larger infotainment touch screens on top of the center console. No less than 29 new nameplates were introduced in the first 11 months of 2016, of which 3 from all-new brands: Borgward, SWM and Hanteng.

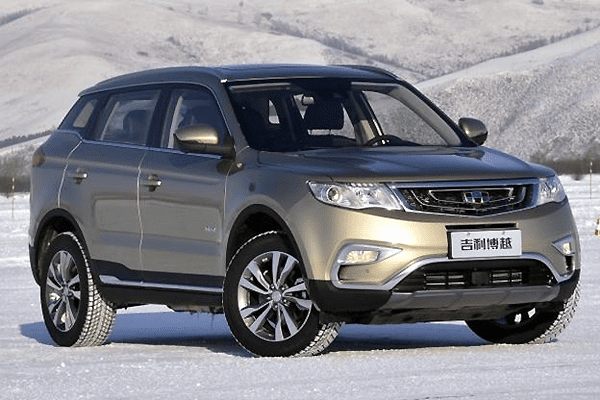

The most successful new introductions into the segment were the Geely Boyue with 88.800 sales in its first 9 months of sales, peaking at 18.500 units in November, and the SAIC Roewe RX5 with 62.250 sales in just 5 months time, peaking at 21.300 units in November. Also worth mentioning are the Changan CX70 with 70.600 sales in 8 months time and the Changan CS15 with 67.600 sales in 9 months time, both peaking at just over 10.000 monthly sales. Besides these hot new launches, existing models also continued to improve and the Haval H6 may be the best example. After Haval slashed the price of its best selling model halfway through the year, sales have shot through the roof: over half a million sales in the first 11 months of the year, up 51% on last year, including a 63% jump since June and almost 75% growth in both September and November. The H6 became the first crossover to top the overall model charts in China, in both April and November and the first crossover to top 70.000 monthly sales, also in November. In fact, it’s highly likely to have been the best selling crossover/SUV in the world in November.

The most successful new introductions into the segment were the Geely Boyue with 88.800 sales in its first 9 months of sales, peaking at 18.500 units in November, and the SAIC Roewe RX5 with 62.250 sales in just 5 months time, peaking at 21.300 units in November. Also worth mentioning are the Changan CX70 with 70.600 sales in 8 months time and the Changan CS15 with 67.600 sales in 9 months time, both peaking at just over 10.000 monthly sales. Besides these hot new launches, existing models also continued to improve and the Haval H6 may be the best example. After Haval slashed the price of its best selling model halfway through the year, sales have shot through the roof: over half a million sales in the first 11 months of the year, up 51% on last year, including a 63% jump since June and almost 75% growth in both September and November. The H6 became the first crossover to top the overall model charts in China, in both April and November and the first crossover to top 70.000 monthly sales, also in November. In fact, it’s highly likely to have been the best selling crossover/SUV in the world in November.

2. Geely

We’ve already briefly mentioned the Geely Boyue above, as the best selling new domestic crossover, but the brand that owns Volvo has had more aces up its sleeve in 2016. It has launched 3 more new nameplates last year, and all four of its new models were designed by Volvo designer Peter Horbury, which has resulted in very handsome looking cars, arguably some of the best looking Chinese brand cars on the market. The Emgrand GS hatchback/crossover, Emgrand GL sedan and Vision X6 crossover all peaked at over 10.000 sales within a few months of their launch. As a result, in a market that grew 18%, Geely sales were up 40,9% in the first 11 months of 2016, including 80% gains in both October and November, and breaking the 100.000 monthly sales milestone for the first time in November as well. It also entered the top-10 of best selling brands in China, and #3 domestic brand behind Changan and Haval. Geely is now the Chinese brand best positioned to start exports to mature markets like Europe and US, with ambitious plans it has already revealed for its newly introduced Lynk & Co brand.

We’ve already briefly mentioned the Geely Boyue above, as the best selling new domestic crossover, but the brand that owns Volvo has had more aces up its sleeve in 2016. It has launched 3 more new nameplates last year, and all four of its new models were designed by Volvo designer Peter Horbury, which has resulted in very handsome looking cars, arguably some of the best looking Chinese brand cars on the market. The Emgrand GS hatchback/crossover, Emgrand GL sedan and Vision X6 crossover all peaked at over 10.000 sales within a few months of their launch. As a result, in a market that grew 18%, Geely sales were up 40,9% in the first 11 months of 2016, including 80% gains in both October and November, and breaking the 100.000 monthly sales milestone for the first time in November as well. It also entered the top-10 of best selling brands in China, and #3 domestic brand behind Changan and Haval. Geely is now the Chinese brand best positioned to start exports to mature markets like Europe and US, with ambitious plans it has already revealed for its newly introduced Lynk & Co brand.

To show how competitive Geely’s new models are, let’s compare the Emgrand GL to a direct rival from an import brand, the Chevrolet Cavalier. Both were launched in September 2016, and both are compact sedans developed for the domestic Chinese market. Both are similarly priced at 79.900 yuan (€10.800,- / US$ 11,900) for the Cavalier and 78.800 yuan for the Emgrand GL, but the latter is 18cm (7 inches) longer and has a 10cm (4 inches) longer wheelbase. Design naturally depends on personal taste, but for me the Emgrand GL with its sharp lines looks a lot more modern and handsome than the somewhat stale and uninspired Cavalier, especially from the inside. But what really makes the difference is the technology: where GM gives you an old-fashioned and anemic 1.5-liter naturally aspirated four-cylinder engine with 109hp, mated to five-speed manual or automatic transmissions, for the same price Geely gives you a 1.8-liter four-cylinder with 130hp mated to a much more modern 6-speed manual or Double Clutch Transmissions and an optional 1.3-liter turbocharged engine. No wonder the brand is one of our success stories of 2016.

To show how competitive Geely’s new models are, let’s compare the Emgrand GL to a direct rival from an import brand, the Chevrolet Cavalier. Both were launched in September 2016, and both are compact sedans developed for the domestic Chinese market. Both are similarly priced at 79.900 yuan (€10.800,- / US$ 11,900) for the Cavalier and 78.800 yuan for the Emgrand GL, but the latter is 18cm (7 inches) longer and has a 10cm (4 inches) longer wheelbase. Design naturally depends on personal taste, but for me the Emgrand GL with its sharp lines looks a lot more modern and handsome than the somewhat stale and uninspired Cavalier, especially from the inside. But what really makes the difference is the technology: where GM gives you an old-fashioned and anemic 1.5-liter naturally aspirated four-cylinder engine with 109hp, mated to five-speed manual or automatic transmissions, for the same price Geely gives you a 1.8-liter four-cylinder with 130hp mated to a much more modern 6-speed manual or Double Clutch Transmissions and an optional 1.3-liter turbocharged engine. No wonder the brand is one of our success stories of 2016.

3. Cadillac

2016 was the first year Cadillac has sold more than 100.000 cars in China in 2016, its second-largest market after the United States. Through November, the American brand had doubled its volume of locally produced models to 96.500 units, including tripling its sales in October. The long wheelbase version of the ATS sold almost 5.000 copies in China in November, compared to less than 1.500 for the regular ATS in the States. Similarly, the XTS limousine sells 50% more in China than in its home market, while the all-new XT5 crossover has comparable sales in both markets. Sure, Cadillac is still far behind the German luxury brands in China, but keep in mind it’s been less than 3 years since the brand started to take the Chinese market seriously and jumpstarted local production of key models. From 2007 to 2013, it produced the Seville SLS in low volumes in China, but sales of than model never topped 7.000 annual units, so sales are up 15-fold in just 5 years time with 4 locally produced models. Sure, Audi still sells more than 5 times as many locally produced cars in China, and BMW and Mercedes-Benz sell almost 3 times as many, but Cadillac is also miles ahead of other 2nd tier luxury brands: Lincoln and Lexus don’t have local production at all, which means import duties leave their models too expensive to reach such heights. Acura and Jaguar only started local production of a single model this year, and both sell less than 1.500 units a month of those, and even combined with Land Rover, JLR sells less than half of Cadillac’s volume in China. French luxury brand DS has been a complete failure with bad product planning, selling less than 15.000 units through November, down 22,5% on 2015. Infiniti has only two locally produced models and sells only a quarter of Cadillac’s volume with sales stable on 2015. Volvo is Caddy’s closest rival with 62.500 sales of its two locally produced models in China, an increase of less than 6%. The new S90L should boost the Swedish brand in 2017, but that’s for another article.

2016 was the first year Cadillac has sold more than 100.000 cars in China in 2016, its second-largest market after the United States. Through November, the American brand had doubled its volume of locally produced models to 96.500 units, including tripling its sales in October. The long wheelbase version of the ATS sold almost 5.000 copies in China in November, compared to less than 1.500 for the regular ATS in the States. Similarly, the XTS limousine sells 50% more in China than in its home market, while the all-new XT5 crossover has comparable sales in both markets. Sure, Cadillac is still far behind the German luxury brands in China, but keep in mind it’s been less than 3 years since the brand started to take the Chinese market seriously and jumpstarted local production of key models. From 2007 to 2013, it produced the Seville SLS in low volumes in China, but sales of than model never topped 7.000 annual units, so sales are up 15-fold in just 5 years time with 4 locally produced models. Sure, Audi still sells more than 5 times as many locally produced cars in China, and BMW and Mercedes-Benz sell almost 3 times as many, but Cadillac is also miles ahead of other 2nd tier luxury brands: Lincoln and Lexus don’t have local production at all, which means import duties leave their models too expensive to reach such heights. Acura and Jaguar only started local production of a single model this year, and both sell less than 1.500 units a month of those, and even combined with Land Rover, JLR sells less than half of Cadillac’s volume in China. French luxury brand DS has been a complete failure with bad product planning, selling less than 15.000 units through November, down 22,5% on 2015. Infiniti has only two locally produced models and sells only a quarter of Cadillac’s volume with sales stable on 2015. Volvo is Caddy’s closest rival with 62.500 sales of its two locally produced models in China, an increase of less than 6%. The new S90L should boost the Swedish brand in 2017, but that’s for another article.

4. Baojun 310

China has always been a sedan market, which as you can read above is shifting towards a crossover market. Local brands have sold cheap hatchbacks with limited success: the Changan Benni (also known as Changan BenBen) has been one of the most successful, it starts at 44.900 yuan and sold 47.800 units in 2016 through November. In that same period Chery sold 15.800 copies of its New QQ, which sells for 37.900 yuan. For the same price you can get a Toyota Aygo 1st generation clone called BYD F0, which less than 10.000 people did. 2016 also (finally) marked the end of the line for the cheapest car in China (and probably the world): the Jiangnan Alto TT, which could’ve been yours for just 20.800 yuan (€ 2.850,- / US$ 2,995), never mind that it was a 32-year old design. In that same line of thought, Baojun sells the Lechi, which is a first generation Daewoo Matiz/Chevrolet Spark, a car almost 20 years old already, for 39.800 yuan. But Baojun didn’t give up on the segment, it has breathed new life into it in 2016, with the introduction of the 310 hatchback, which basically kills the Lechi because it looks (and is) much more modern, is larger and undercuts it in price, starting at at an incredibly low 36.800 yuan (€4.990,- / US$ 5,470) and even has a color touchscreen on top of its center console.

China has always been a sedan market, which as you can read above is shifting towards a crossover market. Local brands have sold cheap hatchbacks with limited success: the Changan Benni (also known as Changan BenBen) has been one of the most successful, it starts at 44.900 yuan and sold 47.800 units in 2016 through November. In that same period Chery sold 15.800 copies of its New QQ, which sells for 37.900 yuan. For the same price you can get a Toyota Aygo 1st generation clone called BYD F0, which less than 10.000 people did. 2016 also (finally) marked the end of the line for the cheapest car in China (and probably the world): the Jiangnan Alto TT, which could’ve been yours for just 20.800 yuan (€ 2.850,- / US$ 2,995), never mind that it was a 32-year old design. In that same line of thought, Baojun sells the Lechi, which is a first generation Daewoo Matiz/Chevrolet Spark, a car almost 20 years old already, for 39.800 yuan. But Baojun didn’t give up on the segment, it has breathed new life into it in 2016, with the introduction of the 310 hatchback, which basically kills the Lechi because it looks (and is) much more modern, is larger and undercuts it in price, starting at at an incredibly low 36.800 yuan (€4.990,- / US$ 5,470) and even has a color touchscreen on top of its center console.

Launched in September, the 310 has sold 32.000 units in three months time, peaking at over 15.000 sales in November, more than its predecessor Lechi sold in all of 2015. In November it also scored an overall top-50 position in the ranking of best selling models in China as it was by far the best selling domestic hatchback and almost the best selling hatchback in China, only, 1.100 sales behind the VW Golf and VW Polo. It also helped to boost Baojun brand sales above 90.000 monthly units for the first time ever. Who’d have expected in such a market people would be lining up to buy cheap domestic hatchbacks?

What are your surprises of 2016? And do you have a brand or model in mind that may surprise next year? Let me know in the comments below.