Unlike many other brands, which are adding models to fill up every possible niche, Peugeot has changed its strategy to focus on fewer models, and focusing on segments in which the brand can compete successfully across the globe, increasing economies of scale. Carlos Tavares, the new CEO of PSA Peugeot-Citroën who is responsible for bringing the company back into profitable territory, has outlined a number of strategies to turn the company around, and one of them is to increase transaction prices.

Unlike many other brands, which are adding models to fill up every possible niche, Peugeot has changed its strategy to focus on fewer models, and focusing on segments in which the brand can compete successfully across the globe, increasing economies of scale. Carlos Tavares, the new CEO of PSA Peugeot-Citroën who is responsible for bringing the company back into profitable territory, has outlined a number of strategies to turn the company around, and one of them is to increase transaction prices.

This strategy is designed to evolve Peugeot from a regular mainstream brand into an upper-class mainstream brand, to avoid the buzz-word “premium”, as every mainstream manufacturer appears to be aiming for a premium image. Tavares wants to be able to raise transaction prices of Peugeot cars in Europe to match those of its competitor Volkswagen, whereas they are trailing the German brand by almost 7%. His aim is to decrease this deficit to 4,7% in 2016 and to less than 3% in 2020. These increased prices should contribute directly to the company’s bottom line, as production costs remain at a similar level. According to Tavares, the technology and quality of the 208 subcompact, 2008 small crossover and 308 compact are already on par with Volkswagen’s and therefore help improve the Peugeot brand image.

However, models that offer substandard quality and technological advantage, like the 807 large MPV and the 207 Plus subcompact, are likely to face the axe on short notice. Besides that, both are selling at such low volumes (207: less than 10.000 units in the first 4 months of 2014, 807: less than 1.000 sales) that don’t justify the costs of keeping such a model in production, even though they are respectively in their ninth and thirteenth year of production. Looking at these figures, one could conclude that the Mitsubishi ASX-clone Peugeot 4008 is also a likely candidate to be canceled, as it is barely selling better than the 807, but Peugeot has denied this for now. Being Peugeot’s only entrant in the popular midsized SUV-segment, and perhaps high cancellation costs of the contract with Mitsubishi will keep the 4008 alive, for now.

However, models that offer substandard quality and technological advantage, like the 807 large MPV and the 207 Plus subcompact, are likely to face the axe on short notice. Besides that, both are selling at such low volumes (207: less than 10.000 units in the first 4 months of 2014, 807: less than 1.000 sales) that don’t justify the costs of keeping such a model in production, even though they are respectively in their ninth and thirteenth year of production. Looking at these figures, one could conclude that the Mitsubishi ASX-clone Peugeot 4008 is also a likely candidate to be canceled, as it is barely selling better than the 807, but Peugeot has denied this for now. Being Peugeot’s only entrant in the popular midsized SUV-segment, and perhaps high cancellation costs of the contract with Mitsubishi will keep the 4008 alive, for now.

Reducing overlap between Peugeot and Citroën

Another way to be able to raise prices is to reduce overlap between both PSA brands. This will help reduce Peugeot’s number of models from twenty five now to sixteen in 2018 and thirteen in 2022. As a result, the recently introduced minicar 108, like its predecessor a co-development with Toyota, is expected not to be replaced by a third generation and the minicar segment will be covered by Citroën. The same goes for the large MPV segment, where the 807 won’t get a successor, although nothing has been announced officially on a possible replacement of the similar Citroën C8.

I can understand why Peugeot would give up the small and shrinking large MPV segment, especially if its stable mate Citroën already offers such a model, and I wouldn’t be surprised if PSA lets the C4 Grand Picasso can fill up the hole for a 7-seater family van in the line-up. The 3008 and 5008 midsized MPV’s have been relatively successful, but as they are aging and the competition has been modernized, their sales are dropping quickly. Considering the success of the 2008, it would make sense to turn the 3008 into more of a crossover for the next generation, while the 5008 may be dropped to leave this segment to the Citroën C4 (Grand) Picasso.

I can understand why Peugeot would give up the small and shrinking large MPV segment, especially if its stable mate Citroën already offers such a model, and I wouldn’t be surprised if PSA lets the C4 Grand Picasso can fill up the hole for a 7-seater family van in the line-up. The 3008 and 5008 midsized MPV’s have been relatively successful, but as they are aging and the competition has been modernized, their sales are dropping quickly. Considering the success of the 2008, it would make sense to turn the 3008 into more of a crossover for the next generation, while the 5008 may be dropped to leave this segment to the Citroën C4 (Grand) Picasso.

And I support PSA’s decision to make the 108 and C1 minicars more distinguishable from each other compared to the first generation which were exactly the same except for their grille and bumpers, but margins on minicars are low and most manufacturers share development costs and spread them across several brands (VW Up!/Skoda Citigo/ Seat Mii, Renault Twingo/Smart Fortwo, Fiat 500/Fiat Panda/Lancia Ypsilon/Ford Ka, Hyundai i10/Kia Picanto, Opel Agila/Suzuki Splash). Combined sales of the Citroën C1, Peugeot 107 and Toyota Aygo have averaged close to 300.000 annual units in the first six years of production, a feat that will be hard to repeat with only two models, while economies of scale are necessary to make a profit in this segment.

Other models likely to be dropped are Peugeot’s two low-volume entries in Europe’s fastest shrinking segment: convertibles. Especially since there’s almost no market for these models outside of Europe as well. Give the 207 CC and 308 CC another year at most, as the models they are based on have already been replaced and sales have shrunk to all-time low levels. However, the 206 CC was a real image-builder for the regular 206 subcompact and for the Peugeot brand as a whole. Tavares is right to focus on high-volume segments, but shouldn’t forget the power of a halo-car in boosting a brand’s image and attracting attention and customers into the showrooms. The 308-based RCZ coupe is a nice example, and is selling quite well, perhaps Peugeot can turn the next generation into a convertible hard-top roadster? Or even a Targa version would sound great to me.

Other models likely to be dropped are Peugeot’s two low-volume entries in Europe’s fastest shrinking segment: convertibles. Especially since there’s almost no market for these models outside of Europe as well. Give the 207 CC and 308 CC another year at most, as the models they are based on have already been replaced and sales have shrunk to all-time low levels. However, the 206 CC was a real image-builder for the regular 206 subcompact and for the Peugeot brand as a whole. Tavares is right to focus on high-volume segments, but shouldn’t forget the power of a halo-car in boosting a brand’s image and attracting attention and customers into the showrooms. The 308-based RCZ coupe is a nice example, and is selling quite well, perhaps Peugeot can turn the next generation into a convertible hard-top roadster? Or even a Targa version would sound great to me.

Image builders needed too

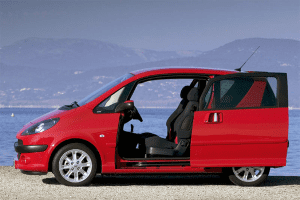

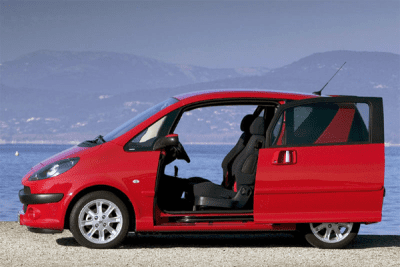

Killing unsuccessful model lines is a short- to mid-term strategy to increase profitability, but if the line-up is trimmed down too far, it may hurt the brand’s image and credibility in the long term. Sure, the 1007 sliding-door minicar has been a financial failure for the company, but that’s largely because it was too heavy (not technologically advanced enough) and too complex (making it too expensive) at the same time. And it helped attract attention to the brand and supported its image as a fashionable automaker.

Killing unsuccessful model lines is a short- to mid-term strategy to increase profitability, but if the line-up is trimmed down too far, it may hurt the brand’s image and credibility in the long term. Sure, the 1007 sliding-door minicar has been a financial failure for the company, but that’s largely because it was too heavy (not technologically advanced enough) and too complex (making it too expensive) at the same time. And it helped attract attention to the brand and supported its image as a fashionable automaker.

As many non-premium large sedans, the Peugeot 607 has been dropped from the line-up in 2010 due to slow sales (less than 150.000 units in 11 years), a direct result of the preference for premium cars in this segment, but still: any self-respecting brand, especially one that inspires to be near-premium, needs a flagship to show off the best of its ability and to rub off favorably on the lower models. Volkswagen also still offers the Phaeton, despite losing money on the model. And even Hyundai has recently introduced the Genesis in Europe, despite having low expectations for its potential volume. Sure, the Koreans can achieve economies of scale thanks to the model’s presence in the USA and South-Korea, but Peugeot could do the same with a 608 in China, where the brand is well-established, and the market loves large European sedans. Perhaps the recent investment by Dongfeng Motor Corporation of China could help matters in this regard. Geely, the Chinese owner of Volvo has similar plans for a premium luxury sedan for the Swedish brand.

Let’s just hope PSA manages to turn a profit again, so there will be money to burn on fun-projects and halo-cars again. Only making high-volume bread-and-butter cars in successful segments may receive praise from the bean-counters, but will turn off enthusiasts to other brands. And the Germans win again……