The most important component of an auto-loan is arguably the interest rate. It directly influences the size of monthly payments and overall loan tenor. Interest rates can even play a role in the final buying decision, powerful enough to override sentimental purchase reasons such as brand loyalty. It goes without saying, therefore, that potential car buyers pay attention to factors that determine their interest rates when shopping for auto-financing options.

One of such factors is the credit score. It is essentially a weighted score that tells auto-lenders how much risk they are taking on by dealing with a prospective borrower. You most likely have a credit report if you have any credit accounts, such as credit cards, mortgages or loans. This report then forms the basis for determining your credit score.

It is not an exact measure, but it does shed light on factors such as the borrower’s willingness and capacity to service the loan. Simply put, the better your credit score, the higher your chances of securing an auto loan with favourable interest rates. This is particularly crucial today as we navigate the era of interest rate hikes and inflationary pressures.

Using your credit score to secure the best interest rates

Via Experian

The overall purpose of the credit score is universal. However, different lenders in different parts of the world have their own criteria to measure an individual’s creditworthiness. When you apply for an auto loan in the US, the lender will run a credit check as part of the process. The majority of the lending institutions use FICO credit scores. This is a 3-digit score assigned to a borrower after the credit check exercise.

It was initially developed in 1989 by a data analytics company called Fair Isaac Company. Today, there are many variations of the FICO algorithm (and other scoring models, for that matter), but they are all aimed at ascertaining the borrower’s ability to take on credit.

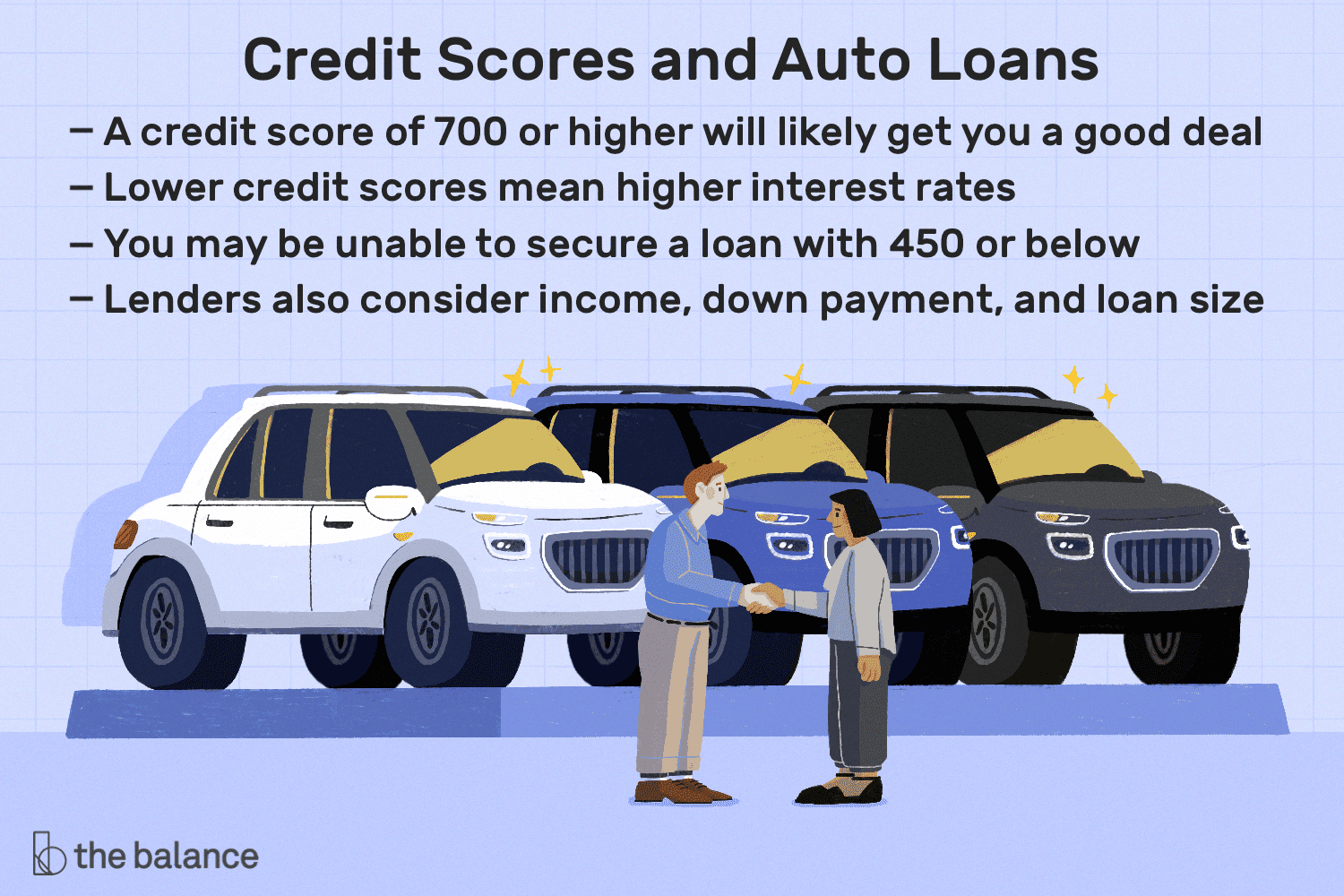

Via The Balance

According to the CFPB (Consumer Financial Protection Bureau) Consumer Credit Panel, there are five different borrower profiles sorted into the following credit score buckets: Super-prime (720 & above); Prime (660-719); Near-prime (620-659); Subprime (580-619); Deep subprime (below 580). A borrower with a score below 660 can still secure auto loans, but they will be more expensive than a Prime or Super-prime borrower with a score north of 661. The logic here is that you will want to keep your credit score as high as possible to get the best deals when shopping for auto loans.

Things that hurt your credit score

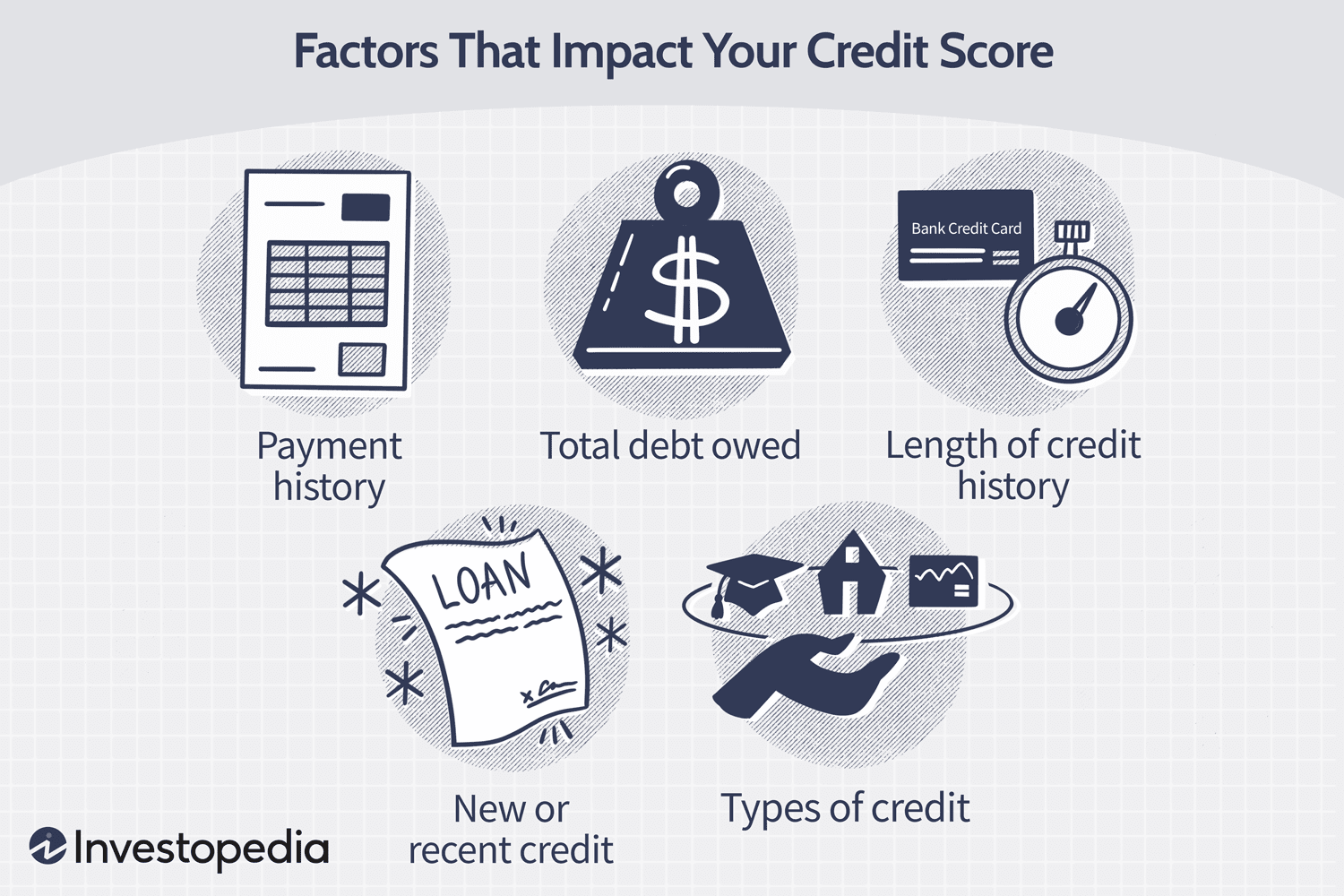

Via Investopedia

An excellent credit score is the result of careful and deliberate planning, and knowing the potential pitfalls can help the borrower avoid making missteps that pull down the score into unwanted territory.

Making a late payment

Payment history on your credit obligations accounts for up to 35% of the FICO score. According to FICO, a payment that is 30 days late can cost someone with a credit score of 780 or higher anywhere from 90 to 110 points. It is important to make payments as at when due and proactively reach out to the lender if, for any reason, payment will be delayed.

A high debt-to-credit utilization ratio

Credit history is built by a constant cycle of credit utilization and pay downs. However, you will want to keep an eye on the proportion of your debt load to overall credit. The lower your balances relative to your total available credit, the better your score will be.

Non-utilization of credit

On the other hand, no credit history for an extended period can also adversely affect the borrower’s credit score. Lenders and creditors have nothing to report to credit bureaus when you don’t utilize your credit accounts. This makes it more challenging to evaluate future loan applications.

Bankruptcy

Filing for bankruptcy has one of the most significant impacts on your credit score. It can wipe as much as 240 points from an individual’s score, and what’s more? A bankruptcy report can stay on the credit history for up to ten years.

This list is by no means exhaustive, and other factors such as frequency of credit applications, credit card closure, charge-offs and refinancing all impact credit scores in varying degrees.

Improving your credit score

Improving your credit score will involve avoiding the pitfalls earlier identified above. Practices such as prompt and regular bill payments, maintaining a low debt-to-credit utilization ratio (ideally about 30%), keeping credit card accounts open and avoiding several loan applications at once are all steps in the right direction.

However, even with all these ‘building blocks’ in place, a great credit score is not instantaneous. It may take a while to see any improvement, especially since negative reports can stay on your credit history for several years. There is no rigid time frame for credit score growth as each person’s financial situation is unique. According to Forbes, it could take anywhere from a month to as much as ten years. Obviously, this is influenced by factors such as the individual’s current credit status and amount of total exposure.

Securing auto loans regardless of credit score

Via Geotab

A high credit score will undoubtedly improve your chances of securing auto financing and locking up the best interest rates. However, it’s not all doom-and-gloom for prospective car buyers with weak scores as they are not entirely without options.

Regardless of your credit score, looking around and considering the various financing options is highly recommended. It is just like shopping for the car itself; an average buyer will evaluate different dealerships and negotiate vigorously before making the final decision.

Banks are the traditional sources for obtaining a loan, but you may be restricting your options if they are your only consideration. Don’t ignore alternative lenders. Working with third-party financing companies, such as getting your auto loan via LoanCenter.com, may provide you with favourable interest rates or financing terms.

It is important to note that simply obtaining auto-loan preapprovals (different from actual loan applications) while shopping around will not impact your credit score since most scoring models do not treat this as a hard enquiry.

In summary, a weak credit score may push the lowest interest rates out of reach. However, having several options will boost your chances of finding a package with an interest rate that fits within your budget and allow you to purchase your desired vehicle.

Thanks so much for talking about how a credit score can help you get a better auto loan. My partner has been wanting to get a new car for some time but doesn’t have to cash to buy anything outright. So we’ve been looking into auto loans and how they work so we can be prepared when we go to buy a new car.