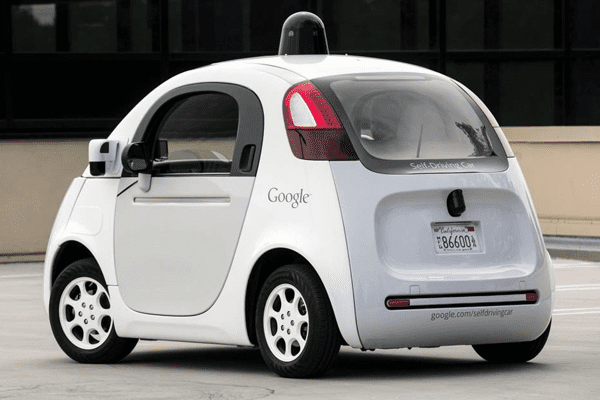

The future of mobility looks quite different from how we know it today, and most automakers are hedging their bets to make sure they’re part of that future, where they may no longer be called automakers but mobility providers. Autonomous driving, car-to-car communication sharing information like traffic conditions and a (at least partial) shift from ownership to a shared economy are among the most likely developments to become mainstream as soon as the next decade. And it’s not only the established automakers that are trying to establish their place in the future, it’s no secret that Apple and Google are aiming for a piece of the mobility pie as well. Although Google is testing with their own Google car, as well as with autonomous versions of existing models, their ultimate goal is not to produce their own cars and become a full-blown auto maker, competing with the likes of Ford, General Motors or Toyota, but rather to become a technology supplier and a mobility supplier, offering self-driving cars that would rival Uber in the ride-sharing business.

The future of mobility looks quite different from how we know it today, and most automakers are hedging their bets to make sure they’re part of that future, where they may no longer be called automakers but mobility providers. Autonomous driving, car-to-car communication sharing information like traffic conditions and a (at least partial) shift from ownership to a shared economy are among the most likely developments to become mainstream as soon as the next decade. And it’s not only the established automakers that are trying to establish their place in the future, it’s no secret that Apple and Google are aiming for a piece of the mobility pie as well. Although Google is testing with their own Google car, as well as with autonomous versions of existing models, their ultimate goal is not to produce their own cars and become a full-blown auto maker, competing with the likes of Ford, General Motors or Toyota, but rather to become a technology supplier and a mobility supplier, offering self-driving cars that would rival Uber in the ride-sharing business.

However, to test and eventually showcase its capabilities in autonomous driving, Google will have to forge a cooperation with an existing automaker and get its system built into one or more of that company’s cars. Such a tie-up would combine Google’s experience from millions of miles of autonomous driving by its fleet of a few dozen self-driving cars with the manufacturing and development capabilities of a large automaker. There have been talks with General Motors, but those fell through as a result of disagreements over ownership of the technology and data which would result from the real-world testing. Then Google started talks with Ford, but apparently that potential deal fell through, as we had expected at least some kind of confirmation by now, considering the rumors had started last December. This week, the Wall Street Journal revealed they’ve talked to someone close to the negotiations between Google’s parent company Alphabet and Fiat Chrysler Automobiles, quoting that the two companies are in the late stage of talks about a technology partnership. “The talks have been ongoing for several months… Alphabet has been seeking industry partnerships with the biggest auto makers in the world, offering a deal to sell self-driving car technology that has been under development for several years.” The new Chrysler Pacifica minivan is believed to be the first model to be supplied with Google’s autonomous driving technology.

considering the rumors had started last December. This week, the Wall Street Journal revealed they’ve talked to someone close to the negotiations between Google’s parent company Alphabet and Fiat Chrysler Automobiles, quoting that the two companies are in the late stage of talks about a technology partnership. “The talks have been ongoing for several months… Alphabet has been seeking industry partnerships with the biggest auto makers in the world, offering a deal to sell self-driving car technology that has been under development for several years.” The new Chrysler Pacifica minivan is believed to be the first model to be supplied with Google’s autonomous driving technology.

Looking at what each of the companies needs from its partner, the deal makes good sense, but looking at what they have to offer each other, this tie-up may not be the match made in heaven. So let’s put the pros and cons in perspective and see if we can make sense of all this:

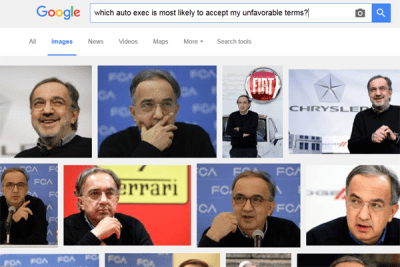

Google needs a partner with manufacturing capacity to build these cars. The few dozens of cars Google has running around today have given it millions of miles of data, but they’ve mostly driven in sun-belt states while in the meantime Tesla is catching up quickly after it updated all existing Model S sedans to have a semi-autonomous mode. The ten thousand or so projected monthly sales of the Pacifica would help Google build a database of real-world autonomous driving experiences all over the States, even if just a fraction of the owners actually use the functionality. At the same time, FCA is lagging far behind its rivals in preparing for the future. Its CEO Sergio Marchionne stubbornly denies that electric cars are the future and has decided to outsource the development of compact and midsized sedans  in order to free up capacity to churn out more fuel guzzling trucks and SUVs which are more profitable in the short term, but will eventually render the company obsolete if it doesn’t look further into the future. Fiat Chrysler Automobiles is using up all of its available resources to build Jeep, Maserati and Alfa Romeo into global powerhouse brands, but as a result the company has no cash to spare on preparing for a future beyond the traditional automobile. A partnership with Google would launch it to the forefront of technology development in a snap of the finger with virtually no investment from its part.

in order to free up capacity to churn out more fuel guzzling trucks and SUVs which are more profitable in the short term, but will eventually render the company obsolete if it doesn’t look further into the future. Fiat Chrysler Automobiles is using up all of its available resources to build Jeep, Maserati and Alfa Romeo into global powerhouse brands, but as a result the company has no cash to spare on preparing for a future beyond the traditional automobile. A partnership with Google would launch it to the forefront of technology development in a snap of the finger with virtually no investment from its part.

However, FCA would probably have to forego owning the rights to that technology and the data that comes from the real-world tests to Google. Then again it has maneuvered itself into a position where it doesn’t really have much of a choice. That makes it a perfect partner to Google, as Ford and GM are working on their own, competing systems for autonomous driving (and for car sharing/ride sharing technology for that matter) and won’t easily let their partner walk away with the crown jewels. So where does that leave FCA? While its two biggest rivals in the US are preparing for the future by investing in a transformation into a mobility supplier, the smallest of the Detroit Three appears to become relegated to just a “dumb” contract manufacturing partner who merely produces and markets vehicles but doesn’t own some of the most important technologies that appear to become the pillars of future mobility. That’s exactly the opposite of what I believe is Tesla’s long-term business plan and not exactly a way to create value for its shareholders.

FCA has been courting other automakers to merge as Marchionne’s vision for the automotive industry states that any automaker producing less than 5,5 to 6 million cars annually is too small to survive. So far, his flirtations have been rejected by every single potential partner, as there’s very little the company has to bring to the negotiation table. A possible tie-up with Google wouldn’t do much to push FCA’s annual production towards that self-declared minimum scale, and there won’t be a lot of synergies (read: overlapping costs that can be cut easily) between the two companies to justify their cooperation. However, those 5,5 to 6 million sales are based on the presumption that automakers are facing increasing R&D investments to keep up with the changing mobility environment, so FCA would cut a significant portion of that tab by working together with Google.

FCA has been courting other automakers to merge as Marchionne’s vision for the automotive industry states that any automaker producing less than 5,5 to 6 million cars annually is too small to survive. So far, his flirtations have been rejected by every single potential partner, as there’s very little the company has to bring to the negotiation table. A possible tie-up with Google wouldn’t do much to push FCA’s annual production towards that self-declared minimum scale, and there won’t be a lot of synergies (read: overlapping costs that can be cut easily) between the two companies to justify their cooperation. However, those 5,5 to 6 million sales are based on the presumption that automakers are facing increasing R&D investments to keep up with the changing mobility environment, so FCA would cut a significant portion of that tab by working together with Google.

FCA may not have many other options than to become Google’s little bitch and Google may not find another automaker willing to accept its killer contract. That means this is not a marriage based on love, but on mutual despair. And that’s hardly a solid foundation for a solid longstanding partnership.

Footnote to Google: I heard a not-to-be-named Japanese automaker is chin-deep in trouble after having confessed cheating with fuel economy figures for the past 25 years. I’m pretty sure they’re looking for someone to take them out of their misery once and for all…..