A few days ago, Bloomberg reported that Nissan’s recently relaunched low-cost Datsun brand was failing in India, as consumers would be reluctant to spend their money on cars that have an image of being cheap, a similar problem that has plagued the Tata Nano. I think this article is a bit of an easy shot at Carlos Ghosn, CEO of the Renault-Nissan Group, who’s known for his bold and ambitious goals, but who hardly fails to deliver on his targets. This makes him a sitting duck for journalists as soon as they can smell even a hiccup in his plans.

A few days ago, Bloomberg reported that Nissan’s recently relaunched low-cost Datsun brand was failing in India, as consumers would be reluctant to spend their money on cars that have an image of being cheap, a similar problem that has plagued the Tata Nano. I think this article is a bit of an easy shot at Carlos Ghosn, CEO of the Renault-Nissan Group, who’s known for his bold and ambitious goals, but who hardly fails to deliver on his targets. This makes him a sitting duck for journalists as soon as they can smell even a hiccup in his plans.

Focus on India

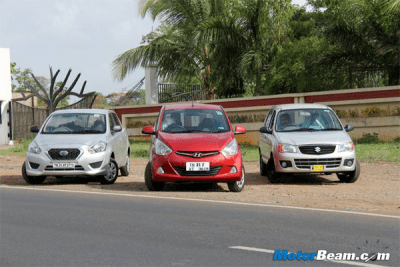

For one, the article focuses exclusively on India, which is the hardest market to crack, something Volkswagen has experienced as well. Local producer Maruti controls over 45% of the car market and therefore achieves great economies of scale and excellent brand recognition. Hyundai locks in another 16% of the market, which leaves the remaining 12 automakers, among which two other local brands Mahindra and Tata, to divide a pie of less than 800.000 annual sales among each other. Introducing a new brand in any market is not a short-term project, perhaps even less so in India, and Ghosn has understood that. With average car ownership still extremely low in India, Ghosn has been quoted to say “the risk is to do nothing” and to miss out on the enormous growth potential of this market in the future.

After India, the Datsun brand has also been introduced in Indonesia, Russia and South Africa. Similar to India, almost half of the Indonesian car market is controlled by a single automaker, with Toyota and Daihatsu selling almost one in every two cars in the country. When trying to sell a car in Indonesia, there’s only one formula for success: Minivans. Datsun has got that message right, as they’re targeting the Indonesian market with the Go+ minivan, which has already claimed a market share of over 2% in its first few months of sales. At over 2.000 units a month, the Go+ is outselling all other Nissan models and the entire Chevrolet and Kia brands. And with the Go hatchback on sale from September, Datsun looks set to hit its short-term target of 40.000 Indonesian sales per year.

After India, the Datsun brand has also been introduced in Indonesia, Russia and South Africa. Similar to India, almost half of the Indonesian car market is controlled by a single automaker, with Toyota and Daihatsu selling almost one in every two cars in the country. When trying to sell a car in Indonesia, there’s only one formula for success: Minivans. Datsun has got that message right, as they’re targeting the Indonesian market with the Go+ minivan, which has already claimed a market share of over 2% in its first few months of sales. At over 2.000 units a month, the Go+ is outselling all other Nissan models and the entire Chevrolet and Kia brands. And with the Go hatchback on sale from September, Datsun looks set to hit its short-term target of 40.000 Indonesian sales per year.

The Russian car market may be in turmoil, but with the recent trade barriers in place, Datsun has an ace up its sleeve: local production. The Datsun on-DO sedan is a rebadged version of Russia’s bestselling car, the Lada Granta, and production has started at AvtoVAZ’s Togliatti plant on July 14th for a market introduction just last month. In its first month of sales, Datsun was already the best selling new brand in Russia and sold almost as many cars as established brands like Fiat and Jeep. With the huge market power (30% market share) and dealership structure of Renault-Nissan-Lada and the successful introduction of the Renault Logan from a few years ago in mind, it’s not hard to imagine a bright future for Datsun in Russia. Detailed South African data is not yet available.

The Russian car market may be in turmoil, but with the recent trade barriers in place, Datsun has an ace up its sleeve: local production. The Datsun on-DO sedan is a rebadged version of Russia’s bestselling car, the Lada Granta, and production has started at AvtoVAZ’s Togliatti plant on July 14th for a market introduction just last month. In its first month of sales, Datsun was already the best selling new brand in Russia and sold almost as many cars as established brands like Fiat and Jeep. With the huge market power (30% market share) and dealership structure of Renault-Nissan-Lada and the successful introduction of the Renault Logan from a few years ago in mind, it’s not hard to imagine a bright future for Datsun in Russia. Detailed South African data is not yet available.

A failure by which measure?

Secondly, I’m not entirely sure the Datsun Go subcompact hatchback can really be called a failure in India yet. The Bloomberg article argues their point by comparing July sales of the Go with those of the Tata Nano, a car which is generally known to have been a failure. But the Go outsold the Nano again in August, and is also selling better than every Nissan model with the exception of the very successful Terrano small SUV, a rebadged Renault Duster.

Bloomberg also compares sales of the Go with those of Maruti and Hyundai, which are established players in the market. But at an average of over 1.500 monthly sales since its launch, the Go is selling better than its direct competitor Honda Brio and easily outselling other subcompact hatchbacks like the Nissan Micra, Fiat Punto, Ford Fiesta Classic and Chevrolet Sail hatchback.

Bloomberg also compares sales of the Go with those of Maruti and Hyundai, which are established players in the market. But at an average of over 1.500 monthly sales since its launch, the Go is selling better than its direct competitor Honda Brio and easily outselling other subcompact hatchbacks like the Nissan Micra, Fiat Punto, Ford Fiesta Classic and Chevrolet Sail hatchback.

Ghosn’s 2017 target is for Datsun to account for at least a third of total group sales in the four countries in which it’s been launched. In its first year of sales, while in start-up mode and with only one model on sale since March 19th, Datsun has already reached half of its target in India, accounting for 15% of Renault-Nissan sales in the country.

Power of the press

The press can make or break a model by calling it a success or a failure early during its launch, and Ghosn isn’t making things easy for himself by setting audacious goals, but I would bet against him even less than I would do so against Sergio Marchionne. I’m sure he’s made the right moves to make Datsun a success in the mid- to long term. Of course the press is skeptical about his ambitious goals and is watching the launch closely, but to call it a failure this soon after the launch would be like calling Lexus a failure for only selling 16.000 cars in its first year in the US.

Jalopnik has quoted the Bloomberg article, stating that Datsun needs a small SUV in India, like the Duster. And although I agree that an SUV would do well considering the successes of the Ford Ecosport and the Duster/Terrano, subcompact cars make up the bulk of the Indian car market by far, so Datsun cannot simply ignore that segment despite it also being one of the most competitive. After the planned introduction of the Go+ 7-seater in India as well, a subcompact sedan, like the Russian on-DO would be a logical next step before moving into the SUV segment. And if they decide to add an SUV to their line-up, it can’t just be another rebadged of the Duster, since the Duster (and the Terrano) are considered upmarket models in India, and making a low-cost Datsun version could hurt the model’s image. Perhaps Datsun could continue to sell a version of the current Duster when Renault introduces the second generation in a few years time.

Jalopnik has quoted the Bloomberg article, stating that Datsun needs a small SUV in India, like the Duster. And although I agree that an SUV would do well considering the successes of the Ford Ecosport and the Duster/Terrano, subcompact cars make up the bulk of the Indian car market by far, so Datsun cannot simply ignore that segment despite it also being one of the most competitive. After the planned introduction of the Go+ 7-seater in India as well, a subcompact sedan, like the Russian on-DO would be a logical next step before moving into the SUV segment. And if they decide to add an SUV to their line-up, it can’t just be another rebadged of the Duster, since the Duster (and the Terrano) are considered upmarket models in India, and making a low-cost Datsun version could hurt the model’s image. Perhaps Datsun could continue to sell a version of the current Duster when Renault introduces the second generation in a few years time.