Budgeting for the purchase of a new vehicle is like opening a cardboard box. Each flap represents large costs. On the one side you have the new vehicle’s price, on another you’ll find fuel costs. Opposite to that there are the costs for maintenance, and on the back side dreaded taxes and fees. Then on the top side you see sickening depreciation and on the bottom – oh, don’t forget the bottom – you must deal with automotive insurance. Eek. Only when all the flaps are folded back do you see, sitting inside the cardboard box, your lofty total.

Compare the prices of two or three vehicles, as GoodCarBadCar.net so often does, and you leave yourself open to absorbing higher costs later on with what first appeared to be the least expensive car. Paying for gas and servicing could be slightly different depending on your choice of transportation, but unless you drive a lot the difference between a few MPGs or the hourly rate at different dealer service departments is unlikely to make or break your decision. As there’s only one thing more certain than taxes, you’re aware enough to take the government’s commission into account. Depreciation matters but is hard to accurately predict, even with countless websites offering a hand. That leaves automotive insurance as a possible deal maker or deal breaker.

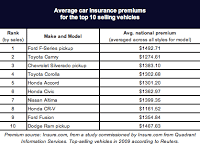

Thankfully, Insure.com commissioned Quadrant Information Services to study nationwide insurance costs on 2010 models, something we’ve seen before from Insure.com on 2009 vehicles. Curiously, the least expensive vehicles on which to acquire automotive insurance aren’t itty-bitty city cars or jumbo heavy-duty pickup trucks or passive-safety-laden luxury cars. No, if you want to save money on auto insurance you’ll be looking at utility vehicles (SUVs, crossovers, CUVs) and minivans. More specifically, the five vehicles listed after the jump. And for the sake of full disclosure, the most expensive vehicles to insure can also be seen, too.

But are these vehicles deserving of your interest? That’s where Insure.com steps back and The Good Car Guy comes to the rescue. The cost of your insurance policy will be higher if you pursue a vehicle with huge levels of horsepower, but Insure.com‘s study includes the mention of a few very interesting factors. What makes one type of vehicle very cheap to insure has more to do with the type of driver typically found in that vehicle than anything relating to the vehicle itself. Minivans, says the study provider, are often sitting at home during peak driving hours, thereby limiting the chance that they’ll be on the roads with thousands of other vehicles. Small cars are often driven by younger, less-experience drivers. In fact, in all of Insure.com‘s Top 20 there isn’t a single car of any kind, no convertible; sedan; hatchback; or wagon.

Keep in mind, GoodCarBadCar.net condensed Insure.com‘s list slightly, removing trim lines and combining identical vehicles. Count on the base versions of the Top 5 being the cheapest to insure. Anything with more cylinders or more luxurious accouterments will cost more to insure. Insure.com has the full run-down of all 20 vehicles and how the national averages were calculated.

#5 – HYUNDAI TUCSON, $1134.08 avg: The latest Tucson has received positive reviews from critics and consumers. Sales are way up. Paired with less-expensive automotive insurance is the Tucson’s low base price, just $18,995. Since all Tucsons are now equipped with just four cylinders, fuel economy isn’t even that much of a touchy subject. Highway ratings go as high as 31 miles per gallon for a front-wheel drive, auto-trans Tucson GLS or Tucson Limited.

#4 – TOYOTA SIENNA, $1133.97 avg: There’s been a lot of Sienna talk around GoodCarBadCar.net lately, ever since the Swagger Wagon promo videos first appeared. It’s still hard to argue with the notion of a minivan for large families. Yeah, you’ll look like an aging parent, but that’s okay, because you are an aging parent. Of course there’s cooler stuff you could be seen driving, but there isn’t anything else so able to haul a houseload of stuff around town.

#3 – CHRYSLER TOWN & COUNTRY/DODGE GRAND CARAVAN, $1119.83 avg: Though not up to minivan par in terms of outright quality and driving pleasure, Chrysler’s minivan duo still sells like crazy in part due to its lower price, but also because of a reputation garnished over three decades. The Town & Country and Grand Caravan both offer ingenious features. It’s also rather apparent that they’re a lot less expensive to insure than your dream vehicle, the Porsche 911 GT2.

#2 – HONDA ODYSSEY, $1095.26 avg: To those seeking security in Honda quality and durability, mercy shall be shown when it comes time to write the cheque for insurance. One of only two vehicles in the study to come out with national averages under $1100, the Odyssey has a lot going for it. Beware, the 2011 Odyssey has been revealed and The Good Car Guy isn’t overly enthused.

#1 – MAZDA TRIBUTE, $1070.25 avg: Sharing nearly everything but grille treatment and a badge with the best-selling Ford Escape, the Mazda Tribute – seen at #1 in base form – must still be a desirable vehicle a decade after it was introduced. Hey, if everybody still wants the Escape they kinda want the Tribute too, right? Fret not, if you need the Ford, a few dollars difference in insurance rates can likely be made up by negotiating at the Blue Oval dealership.

10 Most Expensive Vehicles To Insure:

Porsche 911 GT2: $2943.78

Mercedes-Benz S65 AMG: $2863.03

Dodge Viper SRT-10: $2851.89

Porsche Panamera Turbo: $2837.39

Mercedes-Benz CL600: $2754.80

Audi R8: $2751.55

Mercedes-Benz SL600: $2715.86

BMW M6: $2689.13

BMW 760Li: $2565.59

Jaguar XKR Portfolio: $2537.79

Related From GoodCarBadCar.net

2009’s Top 5 Least Expensive Vehicles To Insure In America

2009’s Top 5 Most Expensive Vehicles To Insure In America

2009’s Top 5 Best-Selling Vehicles In America

Why The Toyota Sienna Swagger Wagon Ad Is Perfect

Great analogy!

When you think about it the GT2 being less than triple the cost to insure than a vehicle costing ten times less is kind of a deal.

Cool!I was hoping for the Honda Odyssey in the list and I found it there in the list because I m planning to buy this car by the end of the year.

I have USA auto insurance. There is none to even compare with it. I've had it since I was a Lieutenant in the army, and will not change.