Summary:

- Automakers are reevaluating their 2030 EV goals due to factors like consumer demand, supply chain issues, and economic uncertainty.

- The rise of software-defined vehicles (SDVs) brings potential benefits but also raises concerns about long-term support and cybersecurity.

- Hybrids and plug-in hybrids are emerging as a middle-ground solution, offering a balance between electric efficiency and gasoline range.

- Some automakers are exploring synthetic fuels as a way to reduce emissions from traditional internal combustion engines.

- The future of the auto industry likely involves a diverse mix of powertrains, including EVs, hybrids, and ICE vehicles, to meet various consumer needs and market conditions.

In a seismic shift for an industry that in many respects has long been defined by mechanical engineering, the world of automaking is undergoing a radical transformation. In the last few years, electric vehicles (EVs) have been marketed as a powerful tool to reduce emissions and the impact of climate change. However, achieving an all-electric future is not without its challenges, and in recent months, a more nuanced perspective on electrification has surfaced.

Despite setting ambitious EV adoption goals for 2030-2035, several major automakers are now adjusting their plans. A confluence of consumer demand, supply chain woes, and economic uncertainty has led to a reevaluation of their EV timelines. As if these were not enough, the advent of software-defined vehicles has added a new layer of challenges. Although these cars may promise more advanced functionality and customization, they also present new question marks for cybersecurity, data privacy, and end-of-life vehicle support.

As the automotive industry navigates this complex landscape, it is clear that a balanced approach, combining EVs, hybrids, and internal combustion engines, may be the most sustainable and practical path forward.

The Reality Check: Why Automakers Are Reassessing 2030 EV Goals

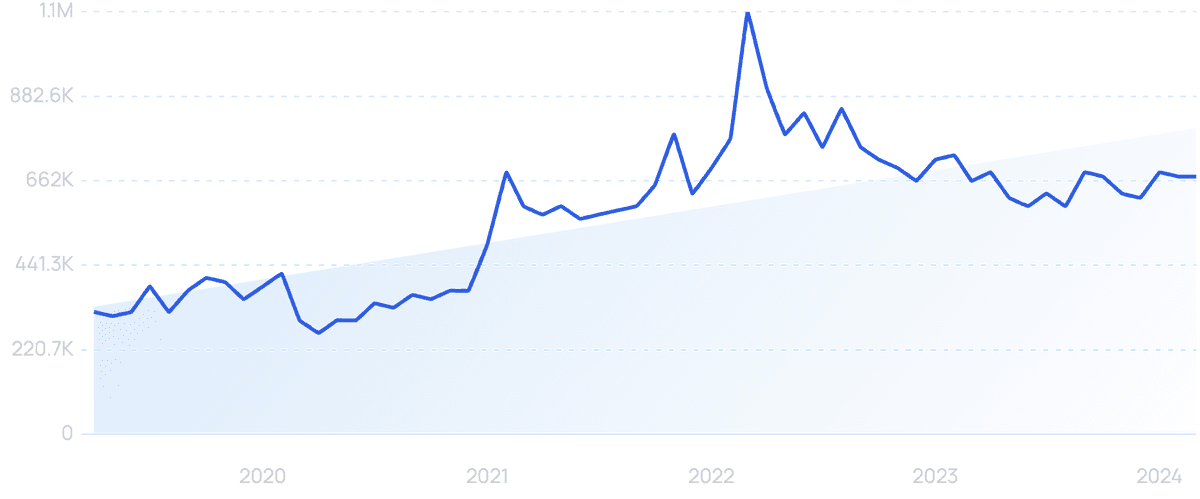

When some of the biggest automakers set ambitious 2030 electrification targets in the early 2020s, they anticipated a swift transition to all-electric lineups due to the rapid advancements in consumer demand, environmental regulations, and all-electric technology. Several companies, such as Renault, Volvo, Mercedes-Benz, and Porsche, set goals to phase out internal combustion engines (ICEs) completely, in keeping with regulatory objectives and broader sustainability initiatives. But as the shift to EVs began to take off, a combination of economic circumstances, a lack of proper infrastructure, and consumer hesitancy complicated the journey.

One factor is that some markets have not adopted EVs as quickly as expected. Steep price tags, underdeveloped charging networks, and concerns about autonomy (range anxiety) and myths surrounding EVs, like being more prone to fires, continue to deter drivers from adopting an EV. Particularly in North America, certain regions lack extensive charging networks, making the transition to complete electrification difficult for drivers who depend on convenient refueling options. As a result, automakers now realize that ICEs might remain in demand for longer than initially projected, prompting them to consider hybrids and plug-in hybrids as a more realistic step toward reducing emissions without abandoning traditional powertrains.

This readjustment has led some companies to consider keeping ICE options alongside EV models. Porsche, for instance, remains committed to its iconic gasoline-powered sports cars, planning to broaden their hybrid offering and potentially gasoline variants of their EV models. These shifts underscore a growing trend among automakers to pursue a broader powertrain strategy, with hybrids and plug-ins acting as transitional solutions, particularly in markets where consumers are not ready for a full EV commitment. Volvo announced in early September that it has modified its goal to become fully electric by 2030, to electrify 90–100% of its sales through EVs and plug-in hybrids. The Mercedes-Benz CEO recently made public plans to extend its investment in internal combustion engine development, suggesting a more balanced approach to powertrain technology. During the third quarter of this year, Mercedes-Benz electric car sales experienced a 31% decline.

The Rise of Software-Defined Vehicles is A Double-Edged Sword

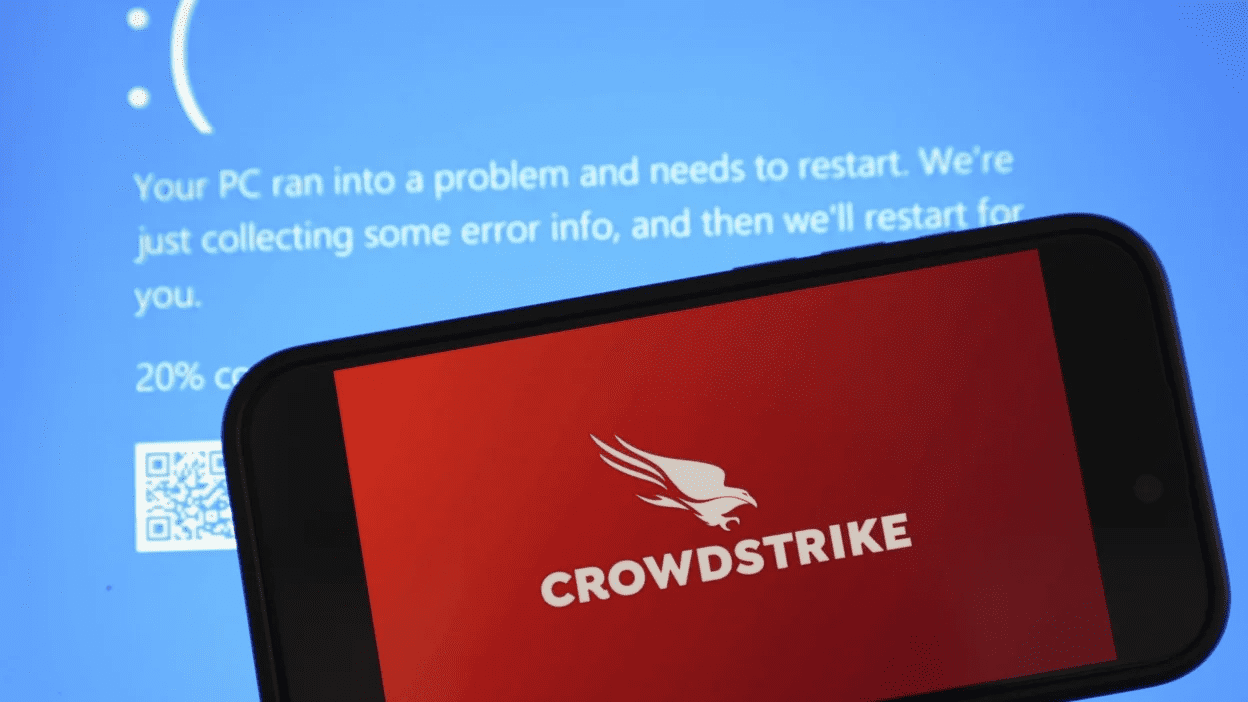

In parallel with the electrification push, automakers have embraced the concept of software-defined vehicles (SDVs) to add value through advanced connectivity, over-the-air updates, and customizable features. SDVs represent a major leap forward, as they allow vehicles to receive ongoing improvements, offer new features, and adapt to changing consumer needs. However, this software-centric approach comes with risks that the industry is only beginning to grapple with.

The recent bankruptcies of companies like Chinese WM Motor and California-based Fisker expose a fundamental vulnerability of SDVs: when automakers fail, software support for their vehicles can disappear overnight. WM Motor’s collapse left customers without access to critical updates and support, effectively stranding them with technology that could become outdated or dysfunctional. Similarly, customers fear that Fisker, now officially out of business, could no longer support their vehicles if the company faces financial challenges again. These cases reveal a potential downside to a vehicle ecosystem increasingly dependent on software: without a stable company backing the product, owners risk losing access to essential updates and features.

Automakers face the challenge of securing long-term support and updates as SDVs continue to evolve to maintain consumer trust. Some brands may even reconsider the extent to which they rely on software-driven features, weighing the flexibility they provide against the risks of leaving customers vulnerable in cases of corporate instability. For consumers, the appeal of SDVs is clear, but the potential for stranded technology poses a new question in the car-buying process: Will the automaker be around to support the car’s software in the years to come?

Why Gasoline-only Models May Stick Around

ICE vehicles are finding unexpected support among automakers and consumers who value the familiarity and flexibility of gasoline engines. For some car companies, particularly those in the luxury and performance segments, the appeal of ICE powertrains remains strong due to their unique driving characteristics and the loyalty of enthusiasts. Porsche’s 911, for example, is set to remain a gasoline-powered icon even as the brand explores electrified powertrains like the Carrera GTS, the first road-legal 911 model to feature a lightweight, performance-focused hybrid powertrain. Porsche is also investing in synthetic e-fuels, which could make it possible for traditional engines to achieve lower emissions without compromising the driving experience.

For consumers who aren’t fully convinced by EVs or hybrids, not to mention hydrogen fuel cell vehicles, gasoline variants might remain a preferred choice in the coming years. Automakers are recognizing that, in certain regions, EV infrastructure won’t meet consumer needs by 2030, and a diverse powertrain portfolio could prove more practical. By retaining ICE options, automakers can cater to drivers who require longer range, quick refueling, or simply prefer the established technology of gasoline engines.

The rise of synthetic fuels may offer an alternative path forward for ICE vehicles, especially in performance and specialty vehicles. Manufactured from renewable sources, synthetic e-fuels promise to reduce the carbon footprint of gasoline engines, thereby extending the sustainability of ICE technology. If synthetic fuels become viable, they could allow automakers to maintain an ICE presence in the market while still working toward environmental goals—a compromise that satisfies both consumer demand and regulatory pressures.

Are Hybrids the Ideal Middle Ground Solution?

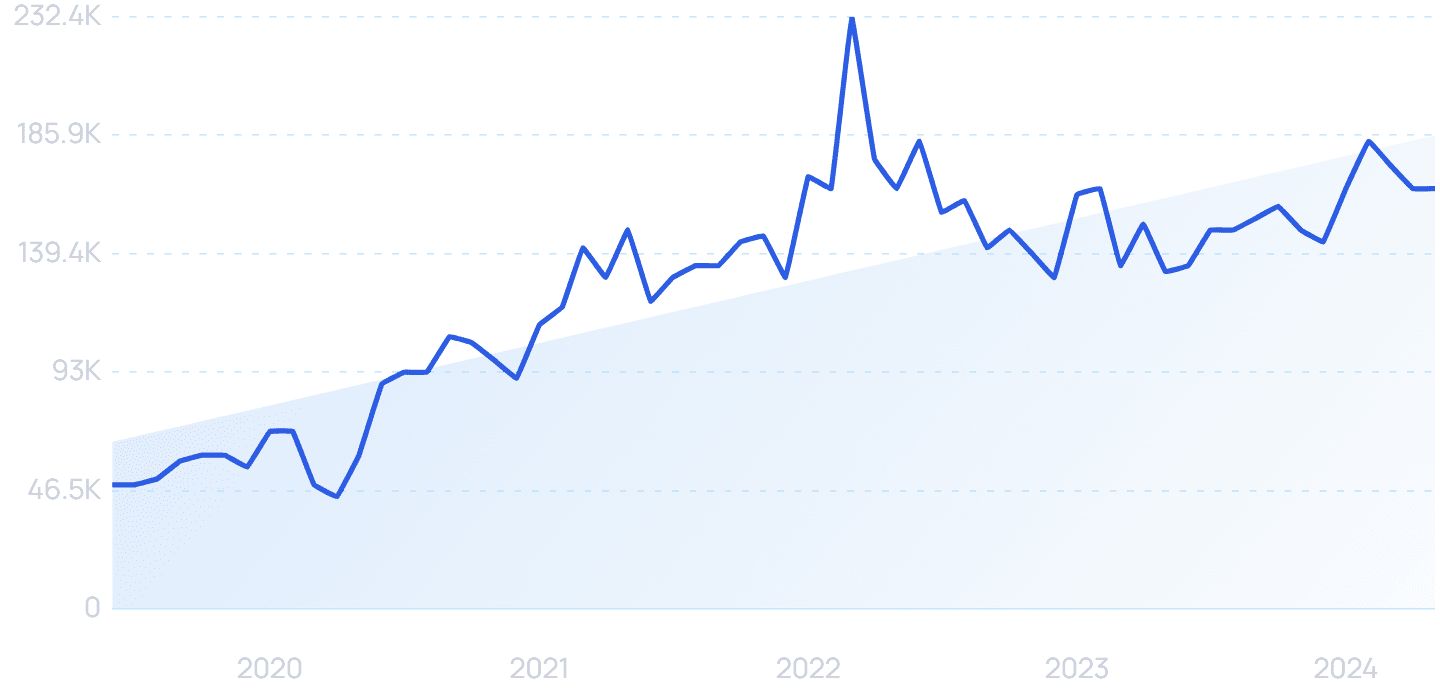

Amid the push for electrification, hybrid electric vehicles (HEVs), and plug-in hybrid vehicles (PHEVs) are emerging as a promising middle ground for consumers not yet ready to make the full switch to EVs. Offering a blend of electric efficiency and gasoline range, hybrids address some of the concerns that have hindered widespread EV adoption, such as range anxiety, charging infrastructure, and battery longevity. In markets where EV support is lacking or consumer adoption is slow, hybrids may become the most practical and popular option by 2030.

Many automakers are responding to this demand by increasing their focus on hybrids, which provide the convenience of an ICE with the fuel savings of an electric motor. Hybrids also allow automakers to reduce emissions gradually, meeting regulatory demands without alienating customers who prefer the flexibility and familiarity of gasoline engines. For instance, plug-in hybrids allow drivers to enjoy an electric-only range for short trips while retaining the ability to refuel quickly on long journeys, a feature that pure EVs often lack.

As the auto industry moves forward, hybrids could redefine the standard for everyday vehicles, particularly in regions where full EV adoption faces significant obstacles. This transitional approach to electrification may extend beyond 2030, with hybrids and plug-ins serving as a durable bridge technology until the world is truly ready for a full EV landscape.

Beyond 2030: What Path Will the Auto Industry Take?

What do you think? Is full electrification feasible in ten years or less, or will we see a more diverse mix of powertrains? Many experts have aimed for a fully electric future by 2030, but trends suggest the industry might adopt a more balanced approach with hybrids, plug-in hybrids, and even advanced ICE options like synthetic fuels.

We predict that most automakers will readjust their strategies, offering a blend of technologies to meet diverse consumer demands, infrastructure readiness, and market stability. This approach could lead to a more flexible auto landscape beyond 2030, allowing for innovation across various fuel and powertrain types, and catering to consumers with a wider range of needs.