Summary

- The global EV market is at a tipping point, with North America and Europe now fighting Asia

- Tesla held the biggest market share in 2023, but BYD Auto out of China came in a very close second

- Trends across all the Chinese are all upwards bound, with BYD Auto set to take over the top global market share

- Tesla is still going to be top 2, but with partnerships starting to become the way to go in the EV space to maximize impact in the entire electrification industry

- We believe that BYD Auto will indeed take the top spot, and with their aggressive international push, will bring some competition to Tesla

- Competition almost always benefits the consumer, so we don’t see this as an overly bad thing!

While most of these article here on GoodCarBadCar are focused on North America, sometimes a look at the world as a whole is appropriate. This is doubly true about the state of the EV market, as while Tesla might have been the biggest EV maker in 2023, market trends are showing that that might soon not be the case, with the biggest challenge emerging from China.

It should be noted that for this analysis, we are referring exclusively to BEVs (Battery Electric Vehicles), and not hybrids or plug-in hybrids.

The Top 10 BEV Makers Of 2023

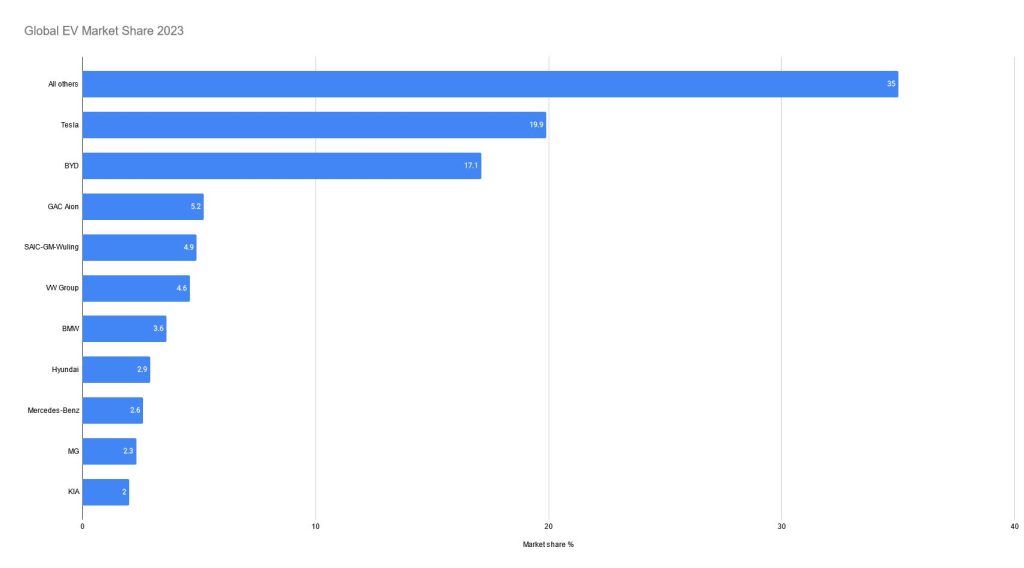

The top 10 EV makers last year accounted for a whopping 65% of the global EV market. Of that gigantic market share, Tesla held 19.9% of it, while Chinese EV maker BYD held 17.1%.

In fact, China holds four of the top 10 spots, with Germany holding 3, South Korea holding 2, and the USA holding only 1.

After Tesla, the next Western EV maker is the Volkswagen Group, at a surprisingly small 4.6% market share. This is surprising as the VW Group controls Audi, Porsche, and VW, all three of which are constantly expanding their electrification technology and EVs in general.

South Korea is represented by Hyundai in 7th place at 2.9% market share, and KIA, whom Hyundai has the controlling share, in 10th at 2.0%.

Globalized EVs: Tesla VS BYD

Tesla moved a gigantic 1.81 million vehicles in 2023, its most successful year to date in terms of sales. It remained the most dominant EV maker in terms of overall presence, as it has footholds in five out of the six major continents.

However, BYD produced over 3 million EV vehicles alone in 2023, and they are pursuing a rapid globalization of production. There are already BYD showrooms appearing in Oceania, Europe, and even right here in North America, with the first two in Astoria, New York and Los Angeles, California.

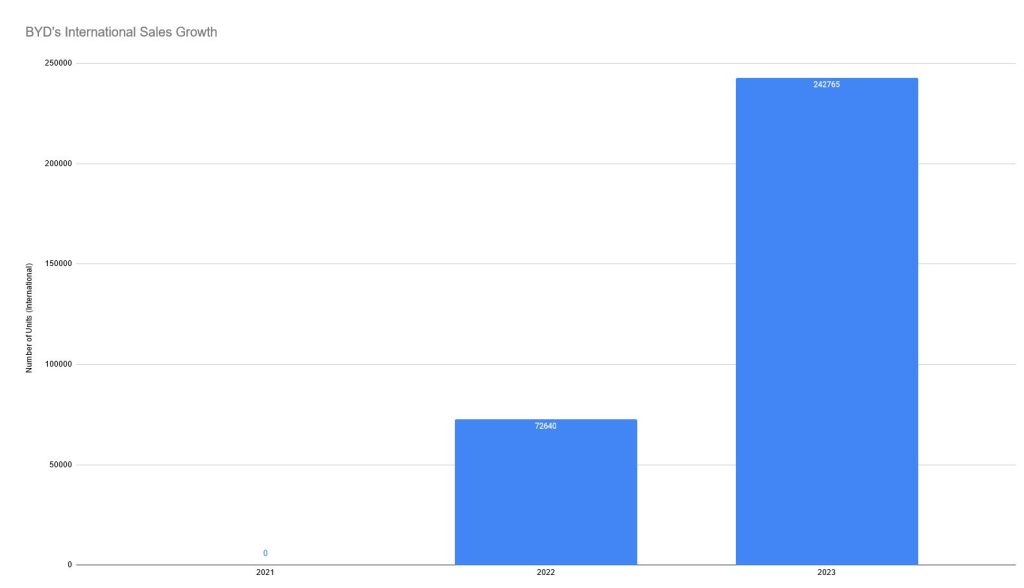

The reality is that it was only through Tesla’s longer-term global efforts that kept it in the lead on market share in 2023. BYD had an absolutely massive year in their domestic market, and had a year-over-year increase in exports of 334.2% to 242,765 units to 70 countries on all six continents.

To put that in perspective, BYD shipped only 72,640 EVs outside of China in 2022, with a global total of 1,796,625 units produced. That means that international sales accounted for only 4% of BYD’s total EV sales that year, compared to 8.1% just 12 months later.

Tesla moved 1.3 million and 1.81 million across those respective timeframes.

The Rest: Partnerships Aplenty

GAC Aion, a newly formed company having existed for only 6 years, has rapidly expanded its interests and global stake, holding 5.2% of the market. While they sell their EVs domestically in China almost exclusively, part of their major market share is the fact that their batteries and EV drivetrains have powered two hypercars: The 2018 Nio EP9 and 2024 Aion Hyper SSR, both of which are 230+ MPH capable EVs.

The next most important brand, holding 4.9% of the global market is SAIC-GM-Wuling. As evidenced by the naming, this is a partnership between SAIC, Wuling Group, and General Motors, and provides the batteries and motors for GM’s EV and hybrid vehicles. They are the providers of the hybrid drive system for the newly announced 2024 Corvette C8 E-Ray, and supplied the batteries and drivetrain of the Chevy Bolt.

After the VW Group, BMW is the next biggest Western EV maker, with a strong push into the luxury and executive EV space with their new i-Series of cars.

The Mercedes-Benz, who are rapidly switching to a full EV model lineup by 2030, hold eighth place with 2.6% market share, with Chinese-owned British brand MG coming in ninth at 2.3%.

Analysis Of Global EV Sales & Future Trends

A massive 13 million units across all electrification types, with just over a third of them BEVs, were produced and sold in 2023. This represents a 29.8% increase over the 9.23 million electrified vehicles produced in 2022, with 2021 to 2022 having seen a massive 54.2% growth.

While there is a bit of a lull in EV sales, now that the proper honeymoon period with the new technology is over, just over one-third of 13 million still comes out to about 5 million units.

It is hard to predict the future trends of the EV space, as hybrids have experienced a massive surge in sales in recent months. Still, with 4.81 million units of roughly 5 million units globally being shared between just two companies, it is not farfetched to project that Tesla should break through the 2 million units produced mark in 2024.

BYD, however, with their explosive growth and aggressive international strategy, is looking like they are trending for over 4.5 million, maybe even 5 million, EVs for 2024. In fact, they are pushing so hard to sell in Europe and North America that factories on both continents are already being built, with the intention being to have domestic production to take advantage of government incentives and eschewing import tariffs completely.

Projecting out the market percentages based on the numbers from this year, that would put BYD at just over 21.8% global market share, with Tesla touching at 20.5%. These numbers do come with a margin of error, as there could be surges from VW Group and Hyundai, with many MY2025 EVs in the pipeline, disrupting things.

We think that BYD is still set to become the dominant EV maker by production in 2024, based purely on data and extrapolated trends. This is never a bad thing, either, as competition, especially between two automakers targeting the same market segments, means the consumer reaps the benefit of lower prices. That, in the EV consumer, is known as a win-win scenario.