In 2017, worldwide sales of passenger cars and light commercial vehicles increased 2,4%, according to JATO Dynamics figures, based on their data of 52 markets. Slightly more than 2 million additional vehicle sales compared to 2016 make for a new total of 86,05 million global car sales. Passenger car sales were up 2,3% to 82 million and LCV sales were up 4,4% to 4,05 million vehicles. 13 out of the 52 markets showed double digit growth including Russia, Argentina and Thailand, balancing small declines in major markets like the UK, United States, South Korea and Mexico. Growth in China slowed to just 2,3% from 17% in 2016. India and Brazil were other engines of growth, the former setting a third consecutive annual sales record and the latter recovering from a decline the year before. Disclaimer: this total excludes some major markets like Iran, the Middle East and Magreb countries, Pakistan, Philippines and a few South American countries. Still, this should give a reasonably accurate picture of the global car market last year. Our own database of 189 countries shows a total of 93,25 million worldwide car sales, an increase of 2,1%. You can find sales records from 2005-2017 for each of these 189 countries in our Car sales by country section or by using the Worldwide Car Sales Data search box at the top right hand corner of our webpages. You can also find historic sales by brand and model in Europe, US and China of almost every car sold in those markets, monthly analyses of brand and model sales for these three markets as well as quarterly segment analyses for Europe and US. Please get in touch with us if you need more detailed data or an analysis of any car market worldwide for your business.

In 2017, worldwide sales of passenger cars and light commercial vehicles increased 2,4%, according to JATO Dynamics figures, based on their data of 52 markets. Slightly more than 2 million additional vehicle sales compared to 2016 make for a new total of 86,05 million global car sales. Passenger car sales were up 2,3% to 82 million and LCV sales were up 4,4% to 4,05 million vehicles. 13 out of the 52 markets showed double digit growth including Russia, Argentina and Thailand, balancing small declines in major markets like the UK, United States, South Korea and Mexico. Growth in China slowed to just 2,3% from 17% in 2016. India and Brazil were other engines of growth, the former setting a third consecutive annual sales record and the latter recovering from a decline the year before. Disclaimer: this total excludes some major markets like Iran, the Middle East and Magreb countries, Pakistan, Philippines and a few South American countries. Still, this should give a reasonably accurate picture of the global car market last year. Our own database of 189 countries shows a total of 93,25 million worldwide car sales, an increase of 2,1%. You can find sales records from 2005-2017 for each of these 189 countries in our Car sales by country section or by using the Worldwide Car Sales Data search box at the top right hand corner of our webpages. You can also find historic sales by brand and model in Europe, US and China of almost every car sold in those markets, monthly analyses of brand and model sales for these three markets as well as quarterly segment analyses for Europe and US. Please get in touch with us if you need more detailed data or an analysis of any car market worldwide for your business.

Worldwide car sales by region

China remains the largest single market with 25,8 million sales despite reporting the slowest growth rate in more than a decade. Car sales in the EMEA region were up 3,5% to 21 million with Germany as the biggest market growing 3% and Russia showing double digit growth after four years of slumping sales. North American car sales decreased 1,5% to 20,9 million vehicles as record sales in Canada (+5% to break 2 million for the first time) were offset by declines in the US (-2% after 7 years of growth) and Mexico (-5% after two record years). Sales in the Asia Pacific region excluding China, Japan and South Korea were up 5,2% to 8,04 million, boosted by India and Thailand (+14% after four years of declines). India may surpass Germany to become the fourth biggest market in the world next year. Australia set another sales record for the third consecutive year, despite just a small gain. Japan was up 2,3% to 5,16 million (of which just 300.000 non-Japanese brands) while South Korea was down 1,8% to 1,76 million. The South America region was the most dynamic, recovering from its crisis with a 14,6% improvement in car sales to 3,4 million. Of the three largest markets in the region Brazil grew by 9% to 2,17 million, Argentina by 26% to 861.000 and Chile by 22% to 370.000 (of which just over 10% Chinese brands). The biggest market not included in the JATO figures is Iran with a 16,6% growth to 1,5 million car sales.

China remains the largest single market with 25,8 million sales despite reporting the slowest growth rate in more than a decade. Car sales in the EMEA region were up 3,5% to 21 million with Germany as the biggest market growing 3% and Russia showing double digit growth after four years of slumping sales. North American car sales decreased 1,5% to 20,9 million vehicles as record sales in Canada (+5% to break 2 million for the first time) were offset by declines in the US (-2% after 7 years of growth) and Mexico (-5% after two record years). Sales in the Asia Pacific region excluding China, Japan and South Korea were up 5,2% to 8,04 million, boosted by India and Thailand (+14% after four years of declines). India may surpass Germany to become the fourth biggest market in the world next year. Australia set another sales record for the third consecutive year, despite just a small gain. Japan was up 2,3% to 5,16 million (of which just 300.000 non-Japanese brands) while South Korea was down 1,8% to 1,76 million. The South America region was the most dynamic, recovering from its crisis with a 14,6% improvement in car sales to 3,4 million. Of the three largest markets in the region Brazil grew by 9% to 2,17 million, Argentina by 26% to 861.000 and Chile by 22% to 370.000 (of which just over 10% Chinese brands). The biggest market not included in the JATO figures is Iran with a 16,6% growth to 1,5 million car sales.

Worldwide car sales by fuel type

Sales of gasoline cars increased 3% to 62,39 million, while sales of diesel-powered passenger cars and LCVs were down by 3,7% to 13,94 million, with its share declining by a full percentage point to 16,2% of the total market. 2 out of every 3 diesel cars sold worldwide in 2017 were sold in Europe, despite increasingly strict regulations on emissions on national levels as well as a growing number of cities banning (older) diesel vehicles from their roads. Thailand, New Zealand and South Korea are also strong markets for diesel vehicles, the former two mostly because of a relatively high share of pickup trucks in their sales charts. Alternative Fuel vehicles, which include hybrids in JATO’s calculations, were up 27,6% to 3,79 million, or 4,4% of the total market. Hybrids were the most popular green cars with sales up 13% to surpass 2,5 million. The entire top-5 of best selling hybrids worldwide consists of Toyota vehicles. The Toyota Prius liftback was the best seller among hybrids with 210.000 units sold (31% of these in the US, 7,8% in Europe and most of the remainder in Japan), but the C-HR hybrid crossover was not far behind with 190.000 sales and may become the best selling hybrid in 2018. The Prius C (also known as Aqua in Japan) was in third place with 149.000 sales, of which 88,3% in Japan and 8,3% in the US, followed by the Yaris hybrid with 131.000 and the RAV4 hybrid with 115.000 deliveries.

Sales of gasoline cars increased 3% to 62,39 million, while sales of diesel-powered passenger cars and LCVs were down by 3,7% to 13,94 million, with its share declining by a full percentage point to 16,2% of the total market. 2 out of every 3 diesel cars sold worldwide in 2017 were sold in Europe, despite increasingly strict regulations on emissions on national levels as well as a growing number of cities banning (older) diesel vehicles from their roads. Thailand, New Zealand and South Korea are also strong markets for diesel vehicles, the former two mostly because of a relatively high share of pickup trucks in their sales charts. Alternative Fuel vehicles, which include hybrids in JATO’s calculations, were up 27,6% to 3,79 million, or 4,4% of the total market. Hybrids were the most popular green cars with sales up 13% to surpass 2,5 million. The entire top-5 of best selling hybrids worldwide consists of Toyota vehicles. The Toyota Prius liftback was the best seller among hybrids with 210.000 units sold (31% of these in the US, 7,8% in Europe and most of the remainder in Japan), but the C-HR hybrid crossover was not far behind with 190.000 sales and may become the best selling hybrid in 2018. The Prius C (also known as Aqua in Japan) was in third place with 149.000 sales, of which 88,3% in Japan and 8,3% in the US, followed by the Yaris hybrid with 131.000 and the RAV4 hybrid with 115.000 deliveries.

Sales of battery electric cars increased 78% in 2017 to 668.000 units worldwide. The world’s best selling EV was the BAIC EC180 with 78.079 sales in its first full year, all in its home market China, also the biggest market for electric cars. The Tesla Model S was in second place with 47.000 deliveries (57,5% in the US and 34% in Europe), just ahead of the Nissan Leaf with 46.000 (24,6% in the US, 36,5% in Europe and 37% in Japan) the Zhidou D2 with 42.342 sales in China. Plug-in hybrid sales increased 63% in 2017 to 417.000 worldwide. Best seller is the Toyota Prius Prime with 52.000 sales (of which 38,5% in the US), ahead of China’s BYD Song crossover with 32.000 sales of the PHEV version, all in its domestic market. The Mitsubishi Outlander PHEV finishes third with 24.000 sales, of which 79% in Europe, followed by the BYD Qin with 20.623 sales in China, and the BMW 330e with 20.000s sales, of which half in Europe. While Japan is the biggest market for alternative fuel vehicles, its 27,8% share trails Norway which has the highest share of green cars with 41,9% of total vehicle sales. In terms of share, Israel is third with 9,5% of its sales either hybrid or electrified.

Sales of battery electric cars increased 78% in 2017 to 668.000 units worldwide. The world’s best selling EV was the BAIC EC180 with 78.079 sales in its first full year, all in its home market China, also the biggest market for electric cars. The Tesla Model S was in second place with 47.000 deliveries (57,5% in the US and 34% in Europe), just ahead of the Nissan Leaf with 46.000 (24,6% in the US, 36,5% in Europe and 37% in Japan) the Zhidou D2 with 42.342 sales in China. Plug-in hybrid sales increased 63% in 2017 to 417.000 worldwide. Best seller is the Toyota Prius Prime with 52.000 sales (of which 38,5% in the US), ahead of China’s BYD Song crossover with 32.000 sales of the PHEV version, all in its domestic market. The Mitsubishi Outlander PHEV finishes third with 24.000 sales, of which 79% in Europe, followed by the BYD Qin with 20.623 sales in China, and the BMW 330e with 20.000s sales, of which half in Europe. While Japan is the biggest market for alternative fuel vehicles, its 27,8% share trails Norway which has the highest share of green cars with 41,9% of total vehicle sales. In terms of share, Israel is third with 9,5% of its sales either hybrid or electrified.

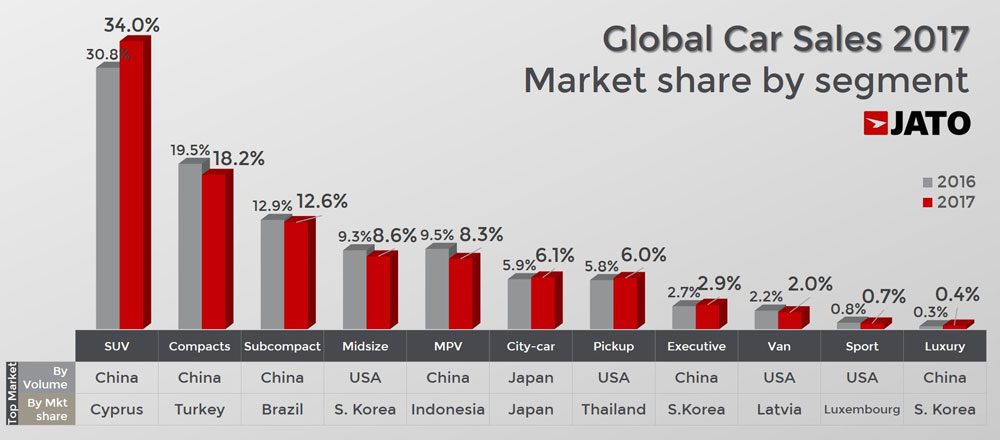

Worldwide car sales by segment

SUV and crossover sales were up 12,7% in 2017 to 27,85 million as they reached a new record market share at 34% of the total passenger car market. This is an 11,5 percentage point growth in just 3 years, as just 16,66 million crossovers and SUVs were sold in 2014. And there’ss till plenty of growth in this type of vehicle, as their share in markets like Argentina, Brazil, India, Mexico, South Africa and Turkey is still below 25% but growing quickly. Compact SUVs (C-segment, Volkswagen Tiguan) accounted for almost 40% of total SUV sales, up 9,2% which is the lowest rate of growth among all SUV segments. Midsized SUV (D-segment, Nissan Rogue/X-Trail) sales were up 16,6% and large SUV (E-segment, Ford Explorer) sales were up 15,7%. The largest market for crossovers and SUVs was China with more than 10 million vehicles, up 13% to a share of 41,5% of the total market. Cyprus has the largest share of crossovers of all 52 markets studied by JATO. Compact car sales decreased 4,5% in 2017 to 14,92 million vehicles and the segment now accounts for 18,2% of the total market, down 1,3 percentage points on 2016. The share of MPVs also plunges with a loss of 1,2 percentage points to 8,3% of the total worldwide car market. This type of vehicle is most popular in Indonesia where more than half of the 1 million annual sales are MPVs, including the top-4 best selling models. The world has bought more midsized cars in 2017 than MPVS, even though the midsized segment loses 0,7 percentage points of share and is struggling in the US and Europe. In South Korea midsized cars  hold the highest share of any market. As one of the only mainstream car segments to grow in 2017, city car/minicar/kei car sales were up 14,4% thanks to booming sales in Japan, the largest market for this type of vehicle, both in terms of absolute sales and market share.

hold the highest share of any market. As one of the only mainstream car segments to grow in 2017, city car/minicar/kei car sales were up 14,4% thanks to booming sales in Japan, the largest market for this type of vehicle, both in terms of absolute sales and market share.

Pickup sales continued to grow thanks to demand for full-sized trucks in North America, their largest market, but also due to increasing popularity of midsized pickups in South America, Asia-Pacific and even Europe, where this type of vehicle has long been virtually invisible. Thailand, where most of the world’s midsized pickups are produced, is also the market with the highest penetration of this type of vehicle, simply because they’re able to carry more people (and stuff) in the back than an MPV or van could.

Worldwide car sales by manufacturer

Thanks to the acquisition of Mitsubishi in 2017, the Renault-Nissan alliance became the biggest manufacturer of passenger cars and LCVs with combined sales up 6,5% to 10,61 million vehicles. This allowed them to leapfrog last year’s leader Volkswagen Group which reported 10,53 million sales in 2017 (excluding heavy trucks from its Scania and MAN brands) , an increase of 4%. Toyota Motor was in third place with 10,2 million sales, up 2% on 2016 and ahead of General Motors which sold 10 million cars for the first time in its more-than-a-century history. Hyundai-Kia sales were down 8% in 2017 to 7,25 million, far behind the company’s goal of 8,25 million for the year which is mostly due to big losses in China, but its brands also struggled in the US. FCA Fiat-Chrysler Automobiles saw stable sales at 4,74 million, just 20.000 more than in 2016. PSA Group’s worldwide sales rose 15% in 2017, its fourth consecutive year of growth. The French company sold 3,63 million cars last year, including 403.900 Opel and Vauxhall cars from August to December, when they were consolidated into PSA’s figures because of the acquisition of the brands from General Motors. The additional Opel/Vauxhall figures also account for most of the company’s growth in 2017 as its existing brands were stable (Peugeot) or declined (Citroën and DS).

Thanks to the acquisition of Mitsubishi in 2017, the Renault-Nissan alliance became the biggest manufacturer of passenger cars and LCVs with combined sales up 6,5% to 10,61 million vehicles. This allowed them to leapfrog last year’s leader Volkswagen Group which reported 10,53 million sales in 2017 (excluding heavy trucks from its Scania and MAN brands) , an increase of 4%. Toyota Motor was in third place with 10,2 million sales, up 2% on 2016 and ahead of General Motors which sold 10 million cars for the first time in its more-than-a-century history. Hyundai-Kia sales were down 8% in 2017 to 7,25 million, far behind the company’s goal of 8,25 million for the year which is mostly due to big losses in China, but its brands also struggled in the US. FCA Fiat-Chrysler Automobiles saw stable sales at 4,74 million, just 20.000 more than in 2016. PSA Group’s worldwide sales rose 15% in 2017, its fourth consecutive year of growth. The French company sold 3,63 million cars last year, including 403.900 Opel and Vauxhall cars from August to December, when they were consolidated into PSA’s figures because of the acquisition of the brands from General Motors. The additional Opel/Vauxhall figures also account for most of the company’s growth in 2017 as its existing brands were stable (Peugeot) or declined (Citroën and DS).

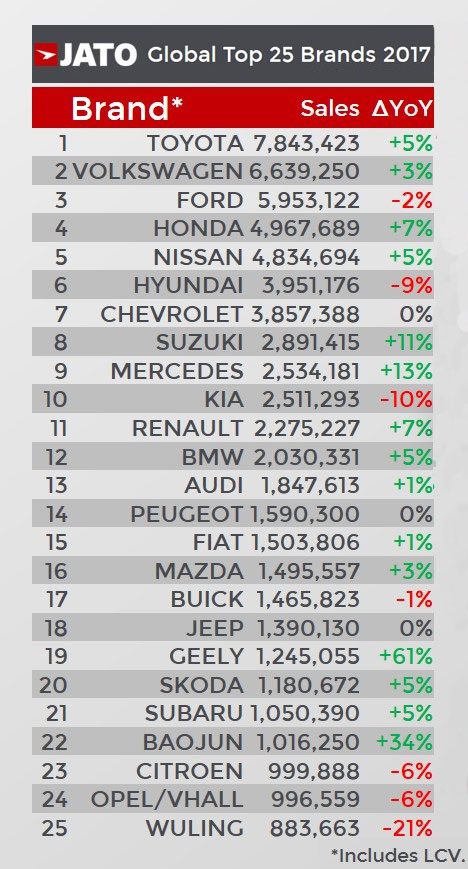

Worldwide car sales by brand

Toyota maintained its position as the best selling car brand worldwide with a margin of 1,2 million sales over Volkswagen, while Ford, Hyundai and Kia were the only brands in the top-10 to see their sales decrease in 2017. Honda was the big winner in the top-5, distancing Nissan thanks to its strong performance in China where Honda sales were up 18,5% in 2017. Suzuki and Mercedes-Benz were the only brands in the top-10 to show double digit increases. Suzuki benefited from the booming India market, where its sales grew 15% and where the Japanese brand is ultra-dominant with almost 50% market share. India accounts for about 55% of Suzuki’s global sales, way ahead of Japan with 23% (up 6,9% in 2017). European Suzuki sales increased 21% in 2017 but still only accounted for 8,3% of its worldwide sales. The brand pulled out of the US market in 2012. Mercedes-Benz remains the best selling luxury brand in the world (especially when including LCVs which are included in these brand figures), ahead of BMW and Audi, both of which increased with single digits. Mazda moved ahead of Buick to take 16th place. Buick depends on China for 83,5% of its global sales, and North America accounts for the rest. Mazda sales are more evenly divided with 21,3% of its sales going to China, 19,4% to the US, 15,6% to Europe and 14% staying in Japan.

Toyota maintained its position as the best selling car brand worldwide with a margin of 1,2 million sales over Volkswagen, while Ford, Hyundai and Kia were the only brands in the top-10 to see their sales decrease in 2017. Honda was the big winner in the top-5, distancing Nissan thanks to its strong performance in China where Honda sales were up 18,5% in 2017. Suzuki and Mercedes-Benz were the only brands in the top-10 to show double digit increases. Suzuki benefited from the booming India market, where its sales grew 15% and where the Japanese brand is ultra-dominant with almost 50% market share. India accounts for about 55% of Suzuki’s global sales, way ahead of Japan with 23% (up 6,9% in 2017). European Suzuki sales increased 21% in 2017 but still only accounted for 8,3% of its worldwide sales. The brand pulled out of the US market in 2012. Mercedes-Benz remains the best selling luxury brand in the world (especially when including LCVs which are included in these brand figures), ahead of BMW and Audi, both of which increased with single digits. Mazda moved ahead of Buick to take 16th place. Buick depends on China for 83,5% of its global sales, and North America accounts for the rest. Mazda sales are more evenly divided with 21,3% of its sales going to China, 19,4% to the US, 15,6% to Europe and 14% staying in Japan.

Geely and Baojun stormed up the charts, entering the top-25 of best selling brands in the world and #1 and #2 Chinese brands with 1,25 million and 1 million sales respectively, all of them in its domestic market. These two brands are logically also the fastest growing in the top-25 and knocked down Wuling which saw its sales decline 21% to 883.000 including LCVs, even though the brand started local production of 2 MPVs in Indonesia (actually, one of them is a rebadged Baojun which is a subsidiairy of General Motors, SAIC and Wuling). Subaru passes the 1 million mark for the first time, and depends on the US for 61,6% of its sales, and sells just 16,8% of its global volume in its home market Japan and just 3,4% in Europe. In contrast, both Citroën and Opel/Vauxhall drop below the 1 million mark with sales down 6% for both. Opel/Vauxhall is solely present in the European market as GM didn’t want it to compete against Chevrolet and Buick in other markets, but PSA is planning to (re-)enter export markets for the brand in order to reduce its dependence on Europe. Skoda improved 5% thanks to continued growth in Europe which accounts for 58,3% of its sales and China which accounts for 28,8%.

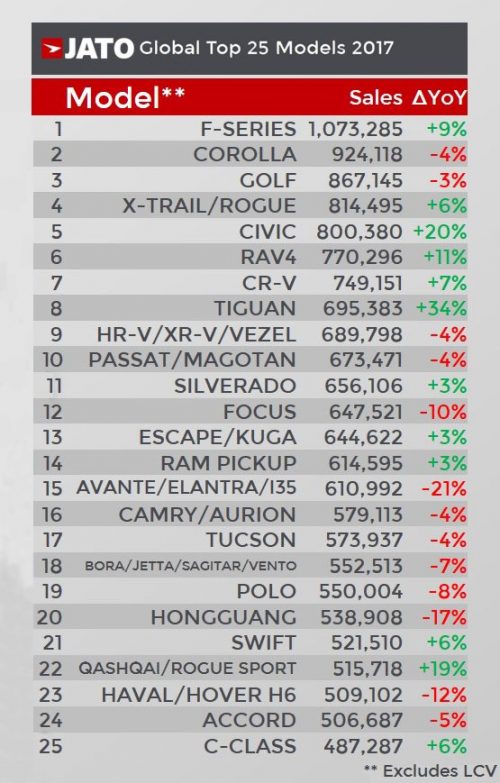

Worldwide car sales by model

Unsurprisingly, the Ford F-Series was once again the world’s best selling nameplate and it topped 1 million sales for the first time, which means it sold more than any brand outside of the top-20 brands ranking. Sales of Ford’s pickup increased 9% thanks to booming sales in the US which accounts for 83,6% of its sales with another 14% going to Canada. The Toyota Corolla is down 4% but holds on to its #2 spot as the Volkswagen Golf is also down, by 3%. The Corolla is more popular in China with 36,4% of its sales, compared to 33% in the US and negligible sales in Europe, while the Golf is most popular in Europe with 55,6% of its sales compared to 17,4% in China and just 8% in the US. Volkswagen has 5 models in the top-25, Honda has 4, Toyota and Ford each have 3 and Nissan and Hyundai each have 2 in the top-25. The Nissan X-Trail/Rogue is the world’s best selling crossover and #4 overall with 814.495 sales, half of which in the US and 22,7% in China. The Honda Civic and Volkswagen Tiguan are the fastest growing models in the top-25 with a 20% gain for the former and 34% for the latter, making it the fourth best selling crossover after the RAV4 and CR-V.

Unsurprisingly, the Ford F-Series was once again the world’s best selling nameplate and it topped 1 million sales for the first time, which means it sold more than any brand outside of the top-20 brands ranking. Sales of Ford’s pickup increased 9% thanks to booming sales in the US which accounts for 83,6% of its sales with another 14% going to Canada. The Toyota Corolla is down 4% but holds on to its #2 spot as the Volkswagen Golf is also down, by 3%. The Corolla is more popular in China with 36,4% of its sales, compared to 33% in the US and negligible sales in Europe, while the Golf is most popular in Europe with 55,6% of its sales compared to 17,4% in China and just 8% in the US. Volkswagen has 5 models in the top-25, Honda has 4, Toyota and Ford each have 3 and Nissan and Hyundai each have 2 in the top-25. The Nissan X-Trail/Rogue is the world’s best selling crossover and #4 overall with 814.495 sales, half of which in the US and 22,7% in China. The Honda Civic and Volkswagen Tiguan are the fastest growing models in the top-25 with a 20% gain for the former and 34% for the latter, making it the fourth best selling crossover after the RAV4 and CR-V.

After falling behind its rival in Q1, the Chevrolet Silverado managed to fend off the RAM pickup as both grew 3% on the final year of their current generations, both also heavily dependent on the US market, at 81,3% for the RAM and a whopping 89,3% for the Silverado. The Toyota Camry is the best selling midsized car worldwide with 2/3 of its sales in the US but no official sales in Europe. The biggest loser in the top-25 is the Hyundai Elantra/Avante with a loss of 21%. The Wuling Hongguang and Haval H6 are the best selling Chinese models in the world but also struggled with double digit declines, both almost fully dependent on their home market China. The Hongguang tumbled to #20 after placing at #7 in the first quarter of the year. Three out of every four Suzuki Swift (including its sedan version Dzire) sold worldwide are for India, compared to 8,5% in Europe and just 2,6% in China. Mercedes-Benz places the C-Class in the models top-25 with 36,3% sold in Europe, over 26,5% in China (we only know sales of the C-Class L sedan in China, not those of the Coupe which is imported) and 15,9% are sold in the US. Among the most popular launches in 2017 were the Baojun 510 (358.800 sales in 10,5 months), Toyota C-HR and the Chevrolet Cavalier which started as a China-only model but also started exports to South-East Asia and South American markets and Mexico. New generations of the Jeep Compass and Peugeot 3008 also proved popular last year.