In the first quarter of 2017, worldwide sales of passenger cars and light commercial vehicles increased almost 5%, according to JATO Dynamics figures, based on their data of 52 markets. Almost a million additional vehicle sales (+962.000) compared to the first quarter of 2016 make for a new total of 21,24 million global sales. Disclaimer: this total excludes some major markets like Iran, the Middle East, Magreb, Pakistan, Philippines and a few South American countries. Still, this should give a reasonably accurate picture of the global car market this year.

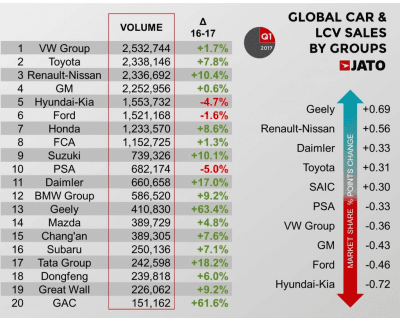

In terms of manufacturers, Renault-Nissan is the big winner at the top, entering the top-3 thanks to a 10,4% increase and reaching within a spitting distance (just 1.500 units) of Toyota (+7,8%). Keep in mind that Renault is relatively strong in Iran and the Magreb countries, while Toyota is dominant in the Middle East and Philippines, so even accounting for those markets the gap between the two companies will be small. Volkswagen still leads despite growing slower than the industry at just +1,7%. GM is down to fourth due to the sale of its European unit Opel/Vauxhall to PSA. The latter is one of the big losers in 2017 due to its struggles in China, where sales are down 46% or almost 70.000 units. Worldwide, PSA lost 5% or 36.000 units, meaning it has grown in the rest of the world, excluding China. Another manufacturer struggling due to China troubles is Hyundai-Kia, due to anti-South-Korean sentiment in the country after increasing tension between the two Koreas. It too has grown in the rest of the world, but its 26% loss in China, which accounts for almost a quarter of its global sales, has pulled the company into the red. Biggest gainer in terms of market share is Geely, thanks to accelerated growth of its namesake brand in its home market China, as well as continued success of its luxury Volvo brand across almost all markets.

In terms of manufacturers, Renault-Nissan is the big winner at the top, entering the top-3 thanks to a 10,4% increase and reaching within a spitting distance (just 1.500 units) of Toyota (+7,8%). Keep in mind that Renault is relatively strong in Iran and the Magreb countries, while Toyota is dominant in the Middle East and Philippines, so even accounting for those markets the gap between the two companies will be small. Volkswagen still leads despite growing slower than the industry at just +1,7%. GM is down to fourth due to the sale of its European unit Opel/Vauxhall to PSA. The latter is one of the big losers in 2017 due to its struggles in China, where sales are down 46% or almost 70.000 units. Worldwide, PSA lost 5% or 36.000 units, meaning it has grown in the rest of the world, excluding China. Another manufacturer struggling due to China troubles is Hyundai-Kia, due to anti-South-Korean sentiment in the country after increasing tension between the two Koreas. It too has grown in the rest of the world, but its 26% loss in China, which accounts for almost a quarter of its global sales, has pulled the company into the red. Biggest gainer in terms of market share is Geely, thanks to accelerated growth of its namesake brand in its home market China, as well as continued success of its luxury Volvo brand across almost all markets.

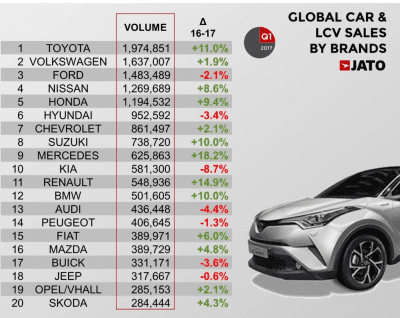

Looking at individual brands, Toyota is still king of the hill, consolidating its leadership by growing faster than any of its 7 closest rivals. Ford holds on to third place but is down by 2,1%, which explains why the company sacked its CEO Mark Fields. He had been groomed for the top job for many years but only held that position for three years, as Ford showed less decisiveness and agility than GM in cutting away money-losing subsidiaries and markets during this period. Suzuki is a notable gainer in the top-10, helped by strong performances in its home market Japan and in India, where its Maruti-Suzuki subsidiary controls almost half (45,5%) of the fast-growing (+11%) market. But Suzuki is also growing in Europe thanks to a wave of new products like the Ignis and Baleno. Mercedes-Benz is the fastest growing brand in the top-20 and the biggest luxury brand worldwide again, as Audi falls to third in that sub-ranking as it too struggles in China due to a dispute with its dealers. After enjoying booming growth for a couple of years, during which it passed the 1 million annual sales milestone, Jeep takes a breather as it replaces the Compass and Patriot compact SUVs with the new generation Compass. This model has already been rolled out in Brazil and China during the first quarter and the US and Europe will follow soon.

Looking at individual brands, Toyota is still king of the hill, consolidating its leadership by growing faster than any of its 7 closest rivals. Ford holds on to third place but is down by 2,1%, which explains why the company sacked its CEO Mark Fields. He had been groomed for the top job for many years but only held that position for three years, as Ford showed less decisiveness and agility than GM in cutting away money-losing subsidiaries and markets during this period. Suzuki is a notable gainer in the top-10, helped by strong performances in its home market Japan and in India, where its Maruti-Suzuki subsidiary controls almost half (45,5%) of the fast-growing (+11%) market. But Suzuki is also growing in Europe thanks to a wave of new products like the Ignis and Baleno. Mercedes-Benz is the fastest growing brand in the top-20 and the biggest luxury brand worldwide again, as Audi falls to third in that sub-ranking as it too struggles in China due to a dispute with its dealers. After enjoying booming growth for a couple of years, during which it passed the 1 million annual sales milestone, Jeep takes a breather as it replaces the Compass and Patriot compact SUVs with the new generation Compass. This model has already been rolled out in Brazil and China during the first quarter and the US and Europe will follow soon.

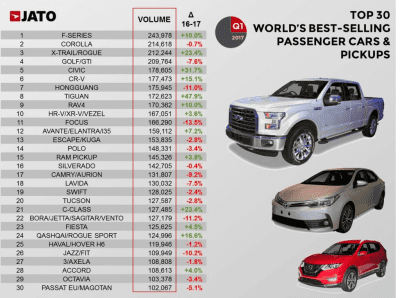

In the models ranking, the Ford F-Series still dominates thanks to its untouchable position in the US, and for the first time in history we have a crossover/SUV in the top-3. The Nissan Rogue/X-Trail passes the Honda CR-V to become the world’s best selling SUV, and also passes the Volkswagen Golf, Wuling Hongguang and Ford Focus to step onto the podium. Keep in mind this does not include sales of its platform sibling Qashqai/Rogue Sport, which is up to 24th place. The Rogue/X-Trail may very well finish 2017 in second place ahead of the Toyota Corolla. The Focus is the big loser in the top-30, dropping out of the top-10 as it’s almost due for a redesign. Behind the CR-V, the Volkswagen Tiguan leapfrogs the Toyota RAV4 and Honda HR-V/XR-V/Vezel to become the #3 crossover in the world. The Tiguan is the only VW in the top-30 to improve, as the Golf, Polo, Lavida, Bora/Jetta/Sagitar/Vento and Euro-Passat/Magotan all show declines. Also worth noting: the RAM Pickup outsells the Chevrolet Silverado for the first time ever, while the Mercedes-Benz C-Class is the top-selling luxury model worldwide, moving past the BMW 3-Series which dropped just outside the top-30 with 100.277 sales.

In the models ranking, the Ford F-Series still dominates thanks to its untouchable position in the US, and for the first time in history we have a crossover/SUV in the top-3. The Nissan Rogue/X-Trail passes the Honda CR-V to become the world’s best selling SUV, and also passes the Volkswagen Golf, Wuling Hongguang and Ford Focus to step onto the podium. Keep in mind this does not include sales of its platform sibling Qashqai/Rogue Sport, which is up to 24th place. The Rogue/X-Trail may very well finish 2017 in second place ahead of the Toyota Corolla. The Focus is the big loser in the top-30, dropping out of the top-10 as it’s almost due for a redesign. Behind the CR-V, the Volkswagen Tiguan leapfrogs the Toyota RAV4 and Honda HR-V/XR-V/Vezel to become the #3 crossover in the world. The Tiguan is the only VW in the top-30 to improve, as the Golf, Polo, Lavida, Bora/Jetta/Sagitar/Vento and Euro-Passat/Magotan all show declines. Also worth noting: the RAM Pickup outsells the Chevrolet Silverado for the first time ever, while the Mercedes-Benz C-Class is the top-selling luxury model worldwide, moving past the BMW 3-Series which dropped just outside the top-30 with 100.277 sales.

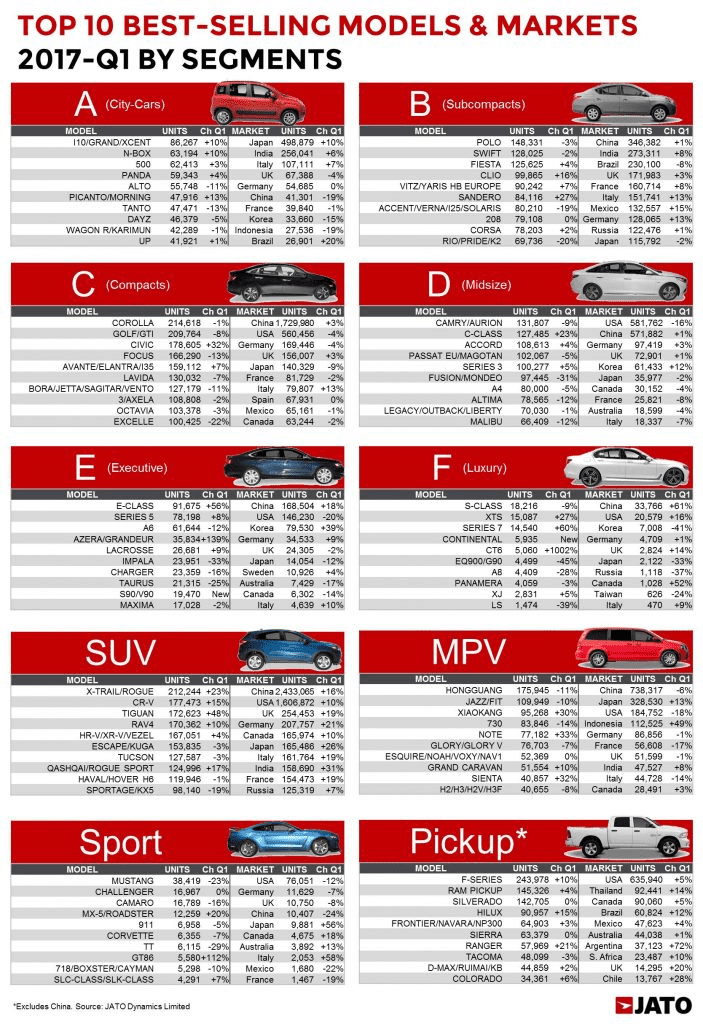

Zooming in on individual segments, the minicar segment worldwide is lead by the Hyundai (Grand) i10/Xcent, ahead of the kei-car Honda N-Box and the Fiat 500 and Panda. Biggest gainer is the Kia Picanto/Morning and the biggest loser in the top-10 is the Suzuki Alto. Winner of the subcompact segment worldwide is the Volkswagen Polo, followed by the Suzuki Swift/Dzire and Ford Fiesta. Biggest gainer is the Renault/Dacia Sandero, while the Kia Rio/K2 and sister model Hyundai Accent/Verna/i25/Solaris both lose close to 20% of their volume. The best selling compact cars are obviously the Toyota Corolla and Volkswagen Golf, while the Honda Civic re-enters the top-3 thanks to its huge improvement. The Buick Excelle is the biggest loser in the top-10 as the old Daewoo-based model which was still sold in China has finally been scrapped. In the midsized segment, the Toyota Camry still leads, but

Zooming in on individual segments, the minicar segment worldwide is lead by the Hyundai (Grand) i10/Xcent, ahead of the kei-car Honda N-Box and the Fiat 500 and Panda. Biggest gainer is the Kia Picanto/Morning and the biggest loser in the top-10 is the Suzuki Alto. Winner of the subcompact segment worldwide is the Volkswagen Polo, followed by the Suzuki Swift/Dzire and Ford Fiesta. Biggest gainer is the Renault/Dacia Sandero, while the Kia Rio/K2 and sister model Hyundai Accent/Verna/i25/Solaris both lose close to 20% of their volume. The best selling compact cars are obviously the Toyota Corolla and Volkswagen Golf, while the Honda Civic re-enters the top-3 thanks to its huge improvement. The Buick Excelle is the biggest loser in the top-10 as the old Daewoo-based model which was still sold in China has finally been scrapped. In the midsized segment, the Toyota Camry still leads, but  the Mercedes-Benz C-Class is closing in quickly, having already overtaken the Honda Accord. Biggest loser is the Ford Fusion/Mondeo, losing almost a third of its worldwide volume. In the large car segment, the Mercedes-Benz E-Class jumps to the top of the ranking, outselling the BMW 5-Series and Audi A6, while the Hyundai Grandeur/Azera more than doubles up, helped by a new generation. Keep in mind this model sells 97% of its volume in its home market South-Korea where it became the overall best seller this quarter. Also worth noting is the arrival of the Volvo S90/V90 in 9th place. The American models are the biggest losers of the segment, as the Chevrolet Impala, Ford Taurus and Dodge Charger all show double digit declines. In the limousine segment, the Mercedes-Benz S-Class remains the top dog, but its dominance is under fire as the Cadillac XTS and BMW 7-Series are growing fast. The Hyundai EQ900/Genesis G90 loses almost half of its volume despite growth in the US, a minor market for the model. It takes a big hit in its home market South-Korea.

the Mercedes-Benz C-Class is closing in quickly, having already overtaken the Honda Accord. Biggest loser is the Ford Fusion/Mondeo, losing almost a third of its worldwide volume. In the large car segment, the Mercedes-Benz E-Class jumps to the top of the ranking, outselling the BMW 5-Series and Audi A6, while the Hyundai Grandeur/Azera more than doubles up, helped by a new generation. Keep in mind this model sells 97% of its volume in its home market South-Korea where it became the overall best seller this quarter. Also worth noting is the arrival of the Volvo S90/V90 in 9th place. The American models are the biggest losers of the segment, as the Chevrolet Impala, Ford Taurus and Dodge Charger all show double digit declines. In the limousine segment, the Mercedes-Benz S-Class remains the top dog, but its dominance is under fire as the Cadillac XTS and BMW 7-Series are growing fast. The Hyundai EQ900/Genesis G90 loses almost half of its volume despite growth in the US, a minor market for the model. It takes a big hit in its home market South-Korea.

The SUV segment we’ve already covered above, except for the biggest loser Kia Sportage/KX5 due to struggles in China. The best selling MPVs are from China: the Wuling Hongguang, Dongfeng Fengguang and Baojun 730, with the Honda Jazz/Fit the odd one in the top-4. The Nissan Note is the big winner thanks to its facelift and success in its home market Japan, where it became the overall best seller thanks to the e-power hybrid version. The world’s best selling sports car is the Ford Mustang, while the Dodge Challenger overtakes the Chevrolet Camaro to take the #2 spot. Biggest gainer is surprisingly the Toyota GT86, while the Audi TT is the biggest loser. The pick-up segment (excluding China) is dominated by the big Americans, outside the top-3 the Toyota Hilux is best of the rest, ahead of the Nissan NP300/Navara/Frontier. Biggest gainer is the Ford Ranger, and there’s just a single loser in the top-10: the Toyota Tacoma.

The SUV segment we’ve already covered above, except for the biggest loser Kia Sportage/KX5 due to struggles in China. The best selling MPVs are from China: the Wuling Hongguang, Dongfeng Fengguang and Baojun 730, with the Honda Jazz/Fit the odd one in the top-4. The Nissan Note is the big winner thanks to its facelift and success in its home market Japan, where it became the overall best seller thanks to the e-power hybrid version. The world’s best selling sports car is the Ford Mustang, while the Dodge Challenger overtakes the Chevrolet Camaro to take the #2 spot. Biggest gainer is surprisingly the Toyota GT86, while the Audi TT is the biggest loser. The pick-up segment (excluding China) is dominated by the big Americans, outside the top-3 the Toyota Hilux is best of the rest, ahead of the Nissan NP300/Navara/Frontier. Biggest gainer is the Ford Ranger, and there’s just a single loser in the top-10: the Toyota Tacoma.