Guangzhou Auto Corp, also known as GAC, is not your father’s typical State-Owned-Enterprise (SOE).

When you think of China’s auto sector and State-Owned-Enterprises (SOEs), what descriptions typically come to mind? Dynamic, innovative, fast-growth? Perhaps not.

Think again, because at least one such enterprise, Guangzhou Auto (aka GAC), is breaking the stereotypes. GAC would appear to be “that kind of company”; meaning dynamic, innovative, and definitely fast-growth – – especially, when compared to other “peer” SOEs.

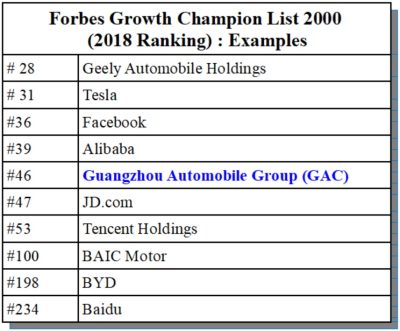

GAC ranked 46th in terms of revenues growth, on The Forbes Growth Champions List 2018 Ranking which listed the fastest growing publicly traded companies around the world.

To help put GAC’s standing into perspective, the table below provides examples of other companies and their respective rankings:

The only domestic competitor above GAC was Geely, the number one domestic OEM in China. GAC’s revenues have been growing at a faster clip than both BAIC and BYD. BAIC, also a State Owned Enterprise, is the only other auto SOE that made the list.

Within China’s massive market, its electric vehicle sub-market is growing fastest. Also known as the New Energy Vehicle/NEV market, this segment grew by 62 percent year-on-year with 1.25 million NEVs sold during 2018. As noted in a China Daily article here, 2019 sales are expected to reach 1.6 million.

Although none of GAC’s NEV models were among the Top Twenty Selling NEVs in China; GAC has had at least some success in the market with its SUV PHEV, the GAC Trumpchi GS4, pictured below:

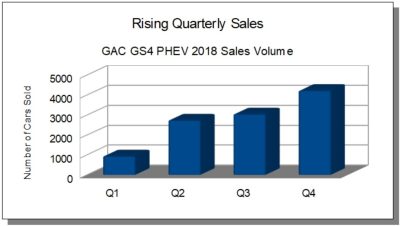

Over 10,900 GS4 PHEVs were sold during 2018, and momentum behind such sales grew on a quarterly basis:

The GS4 PHEV was first launched in June of 2017. During its first six months on the market, 1,863 vehicles were sold. Nearly as many (1,781) were sold in December 2018 alone.

The “after subsidies” price of a GAC GS4 PHEV in China is about 185,800 RMB ($27450). When running purely on its 12kWh battery, the SUV has a maximum range of 58 km. (36 miles). The GS4 has a top speed of 180/kmh (112 mph), and a range of about 240 km. at 60 kmh constant speed. In terms of price and many of the specs. highlighted above, the GS4 PHEV is similar to BYD’s Qin PHEV. The Qin PHEV was recently reviewed in the blog titled BYD Leads China’s EV Market. Although we don’t know for sure whether Chinese car buyers were viewing these two models as natural competitors, we do know from sales volume data that for every one GAC GS4 PHEV sold, BYD sold four Quin PHEVs.

GAC and its Joint Venture Partners: Imitation is the sincerest form of flattery

One development that is particularly interesting about GAC’s SUV PHEV is that a number of GAC’s joint venture (JV) partners have begun selling the same model, or an EV variant, using their own respective badges. Examples include the Toyota ix4 and the Mitsubishi Eupheme. Both Honda and Fiat-Chrysler (FCA) are following this approach with their own respective versions of the GAC GS4.

So why is it that four major international OEMs are copying GAC with the same car, same model, but using their own respective badges? As explained in the Bloomberg article The Car That Will Help Big Automakers Game China’s New Rules, this unusual strategy is driven by a number of factors:

-

-

- Government regulations require manufacturers to meet higher fuel economy standards,

- Beginning this year, OEMs are subject to new policies and regulations designed to address air pollution, carbon emissions, and global warming through the promotion of NEVs. Each OEM that produces more than 30,000 cars per year will have to earn carbon-credits through the production of NEVs, or alternatively; purchase credits from competitors that have surplus credits to sell.

- Many OEMs need additional time before their own NEV product offerings are ready for the market. Partnering with GAC, and selling GS4 variants, effectively buys additional time.

-

GAC in the USA?

GAC has the ambition to break into the American market. In an excellent Automotive News China article by Yang Jian, (What has emboldened GAC to enter the U.S.?) Yang explains the historical and cultural context underlying GAC’s confidence, and the companies entrepreneurial spirit. The company’s headquarters is Guangzhou, a port city, with a long history of foreign trade and a strong culture that supports entrepreneurship. Since GAC’s founding in 1997, the company’s confidence is grounded in actual past achievements which required some risk-taking, a behavior not normally associated with China’s auto-state-owned -enterprises. That risk-taking has paid off. During its early more humble years, GAC’s main business was producing and selling motorcycles and small buses. It wasn’t until 2010 that GAC started producing its first passenger vehicles. That’s right – – you’ve read that right – – the company that now has major joint ventures with Toyota, Honda, Mitsubishi, and FCA – – as well as its own successful and growing domestic brand (Trumpchi) – – has been producing passenger vehicles for less than a decade. Pretty impressive.

The company is expanding its entrepreneurial spirit in numerous directions. These include efforts to enter the US market, as well as efforts to expand its New Energy Vehicle business in general.

GAC’s ambition to establish itself in the American market is not new. As far back as 2013, GAC made its first debut at the Detroit Auto show, as highlighted in an article here. More recently, the company attended the 2019 show and displayed its EV concept car, the Entranze, as pictured below:

Perhaps more importantly, in an effort to engage with dealers, GAC recently attended the North American Dealers Association (NADA) conference in Las Vegas, where meetings were held with 80 dealers and partners. Although GAC had planned to enter the US market this year, that timing has recently been adjusted to mid-2020, as noted here. Trade tensions and tariffs between the US and China have contributed to the delays.

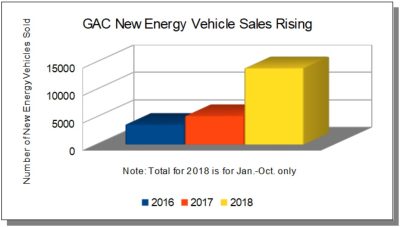

Back home in China, GAC is aggressively pursuing its ambitions to expand its NEV business. Last year, during the first 10 months alone, GAC sold 13,928 NEVs under the Trumpchi brand, according to an article here. While that’s not a large number when compared with other peer competitors like BYD or BAIC, it does, nonetheless, represent a more than doubling of sales from the 5,246 NEV units sold by GAC in 2017. In general, GAC’s new energy sales volume has been on a steady rise upwards over the last three years, as seen in the graph below:

During 2018 GAC’s Trumpchi conventional cars (i.e. cars powered by Internal Combustion Engines) still represented the overwhelming percentage (97%) of vehicles sold under the Trumpchi brand. Accordingly, new energy vehicles with a Trumpchi badge represented only 3%. By 2020, GAC hopes to raise that figure to 10%.

A number of investments, partnerships, and innovative projects are designed to move GAC closer to that goal. One innovative project involves the establishment of a “New Smart Energy” Automobile Industry Park, located in the Guangdong-Hong Kong-Macao Greater Bay Area. GAC and partners have invested 4.5 billion RMB ($670 million), and the total “planning capacity” of the plant is 400,000 vehicles per year. At this facility, solar energy will be used in the manufacturing of new energy vehicles. According to a December 2018 article here, “the first model (Aion S) will be put into mass production in next May, (i.e. May 2019), and it will become the world’s first pure electric vehicle based on solar energy technology.” The park will be partly powered by 52,000 solar (PV) panels. When running at full capacity, the solar energy represents 15% of the plant’s energy needs.

GAC recently released a press release regarding the Aion S, and like so many other newcomers and challengers to Tesla, the language from the challenger was direct and pointed, with the headline reading “GAC NE’s New EV Sedan Travels Further Than Tesla Model 3.”

According to the GAC press release, “the Model 3 Long-range version delivers 310 miles (499 km). However, GAC NE’s Aion S can run up to 392 miles (630 km) on a single charge, making it the best performing EV sedan so far.”

Not everyone is convinced that GAC’s claims of a longer range are valid, due to a lack of specificity regarding the “test cycle” used when making the claim, as noted in an article here.

Other recent developments should support GAC’s efforts to break into the American market or to become a more serious contender in the NEV space. These include:

-

Establishing a new regional headquarters in California. The focus will be on branding, marketing, product planning, and also design and R&D operations in the state.

-

Establishing a 50,000 sq. foot R&D facility in Farmington Hills Michigan, near Detroit. Engineers from both the Michigan facility and the California facility will collaborate on new product development.

-

Creating two joint venture partnerships with Contemporary Amperex (CATL), China’s large battery manufacturer. The purpose is to ensure GAC’s battery supply, both for its domestic brand, as well as for its joint ventures with international OEMs. The value or registered capital of one of these ventures is 1 billion RMB ($148 million), while the value of the other is not known. For more details about both, click on the Automotive News China article here.

-

Investing 650.1 million RMB ($96 million) in a New Energy Vehicle Project known as “A20”.

Although little is known about the A20 project, it seems safe to suggest that it is R&D related and that its intent is to contribute to GAC’s future competitiveness in the NEV market.

GAC’s presence in California and Michigan is very recent. As such, it is too early to tell what types of impacts these investments might eventually have.

From a nearer term perspective, GAC’s Aion S is scheduled for launch in May of 2019, and industry observers (including this one) will undoubtedly be looking for signs of traction and market acceptance, during the 2nd and 3rd quarters of this year. Stay tuned.

As emphasized earlier in this piece, GAC truly is a unique and atypical state-owned-enterprise in China’s auto sector. Its track record of fast-growth, entrepreneurial spirit, and innovative culture, clearly makes it a company worth following during 2019, and well beyond.

For a complete list of sources and references used in this article; click here.

Full disclosure: I currently do not own shares in GAC or any other company mentioned in this article.