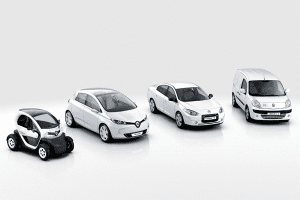

As the Renault-Nissan alliance celebrates a combined tally of 200.000 Zero Emission vehicles worldwide, the Renault brand has something to celebrate all by itself in Europe before the end of the year. Total sales of its four-vehicle lineup of full-electric vehicles have added up to 48.471 units by the end of October 2014. The French brand sold 1.971 Zero Emission vehicles in October, so there’s a good chance the 50.000-unit threshold will be broken in November.

The Zoe subcompact, Kangoo Cargo Van and Twizy quadricycle have sold in virtually equal numbers, each taking almost one third of the cumulative volume, while the Fluence compact sedan has been much less successful, taking less than five percent of the brand’s cumulative Zero Emission sales. That’s not very surprising, considering the Fluence didn’t have a quick-charge option and therefore takes up to eight hours to recharge. Besides that, a compact sedan isn’t a very popular body style in Europe, and its bland design hasn’t helped either. The Zoe has been the latest to reach the market and has been the strongest selling model of the lineup, contributing to over half of this year’s Zero Emission sales for Renault.

The Zoe subcompact, Kangoo Cargo Van and Twizy quadricycle have sold in virtually equal numbers, each taking almost one third of the cumulative volume, while the Fluence compact sedan has been much less successful, taking less than five percent of the brand’s cumulative Zero Emission sales. That’s not very surprising, considering the Fluence didn’t have a quick-charge option and therefore takes up to eight hours to recharge. Besides that, a compact sedan isn’t a very popular body style in Europe, and its bland design hasn’t helped either. The Zoe has been the latest to reach the market and has been the strongest selling model of the lineup, contributing to over half of this year’s Zero Emission sales for Renault.

In contrast to its Alliance partner Nissan, which sells its Leaf compact hatchback in other continents as well, mainly North America and Japan, Renault’s EV sales are almost entirely limited to Europe.

Only 1.752 Renault Z.E. vehicles have been registered outside of Europe, with the Fluence taking the bulk of those, almost 1.500 units, which is 40% of the model’s worldwide sales.

Only 1.752 Renault Z.E. vehicles have been registered outside of Europe, with the Fluence taking the bulk of those, almost 1.500 units, which is 40% of the model’s worldwide sales.  Two thirds of those, or almost 1.000 cars have been sold in Israel as part of the failed battery switching project Better Place, which had ambitiously agreed to buy no less than 100.000 Fluence Z.E. sedans from Renault, but filed for bankruptcy in 2013 as its goals turned out hard to achieve. The model has been pulled from the European market due to slow sales, but gets a second life in South Korea, where it’s sold as the Samsung SM3 EV, including an on-board quick-charger. Renault seems to have learnt from its mistakes.

Two thirds of those, or almost 1.000 cars have been sold in Israel as part of the failed battery switching project Better Place, which had ambitiously agreed to buy no less than 100.000 Fluence Z.E. sedans from Renault, but filed for bankruptcy in 2013 as its goals turned out hard to achieve. The model has been pulled from the European market due to slow sales, but gets a second life in South Korea, where it’s sold as the Samsung SM3 EV, including an on-board quick-charger. Renault seems to have learnt from its mistakes.

The Renault Kangoo Z.E. Cargo Van is intended as a fleet vehicle, so naturally a few large commercial customers have taken a huge chunk of the model’s sales. The most prominent of which is La Poste, the French postal service, which has taken delivery of its 5.000th Kangoo Z.E. last month. That’s one third of all sales of the model and ten percent of all Renault Zero Emission vehicles. Another 5.000 are planned to be delivered in the coming years.

The Renault Kangoo Z.E. Cargo Van is intended as a fleet vehicle, so naturally a few large commercial customers have taken a huge chunk of the model’s sales. The most prominent of which is La Poste, the French postal service, which has taken delivery of its 5.000th Kangoo Z.E. last month. That’s one third of all sales of the model and ten percent of all Renault Zero Emission vehicles. Another 5.000 are planned to be delivered in the coming years.

In the mean time, Nissan has sold almost 30.000 units of its Leaf EV in Europe as well, and it’s selling at a similar pace as Renault’s four models combined. The Leaf topped the 2.000 monthly sales mark for the first time ever in September and its sales have continued to grow every year since its introduction in 2011. In contrast, 2014 may be the first year that Renault’s Zero Emission sales decrease, as sales of the Fluence Z.E. have come to a halt and the three other models show a slight year-over-year decrease.

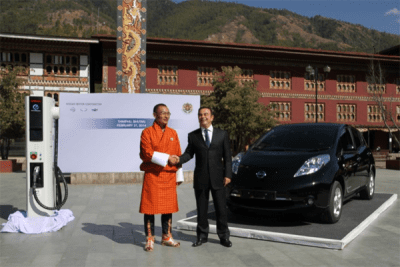

The 200.000 combined sales of Zero Emission vehicles worldwide, Renault-Nissan is still far from its initial target of 1,5 million cumulative sales by the end of 2016, a goal that’s already been abandoned last year, when Carlos Ghosn announced the 1,5 million mark would be reached with a four-year delay, by 2020. According to Ghosn, reaching the EV goal depends on how quickly electric mobility is embraced by governments around the world, most notably in developing countries where he believes lies great potential for electric cars.

The 200.000 combined sales of Zero Emission vehicles worldwide, Renault-Nissan is still far from its initial target of 1,5 million cumulative sales by the end of 2016, a goal that’s already been abandoned last year, when Carlos Ghosn announced the 1,5 million mark would be reached with a four-year delay, by 2020. According to Ghosn, reaching the EV goal depends on how quickly electric mobility is embraced by governments around the world, most notably in developing countries where he believes lies great potential for electric cars.

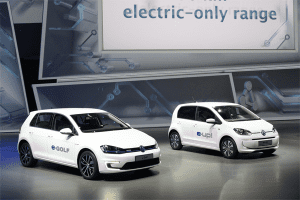

With a flock of new competitors hitting the European market, Renault-Nissan looks set to lose its virtual monopoly on affordable electric cars (considering the Tesla Model S is in a whole other league). The biggest threat will come from Volkswagen, which has just introduced the e-Up! and e-Golf, with Kia’s Soul EV as a smaller player in the segment.

An increasing number of players on the EV market doesn’t necessarily mean bad news for Renault-Nissan, as this will help the acceptance of this kind of technology by the public, and will increase awareness for Zero Emission vehicles. I think the biggest threat to full electric cars will come from a flood of Plug-In Hybrid cars that have recently arrived in showrooms or are on their way.

The BMW i3 is already selling at a similar rate as the Renault Zoe, and Volkswagen Group has just introduced the Golf GTE and its sibling Audi A3 e-tron, with the Passat GTE planned for next year. Plug-in Hybrids are more expensive than full EVs (the Golf GTE costs € 2.000,- more than the e-Golf in Germany) because they’re equipped with both an internal combustion engine and an electric powertrain, but the added ICE takes away the range anxiety that consumers may have with electric cars. For example, most buyers of the BMW i3 spend an extra € 4.500,- to get the optional range-extending gasoline engine. Sales of Plug-In Hybrids in Europe has surged almost 250% to 27.280 in the first nine months of 2014, up from 7.879 in the same period last year, compared to just over 38.500 EVs, which is up 50% from 25.700.

The BMW i3 is already selling at a similar rate as the Renault Zoe, and Volkswagen Group has just introduced the Golf GTE and its sibling Audi A3 e-tron, with the Passat GTE planned for next year. Plug-in Hybrids are more expensive than full EVs (the Golf GTE costs € 2.000,- more than the e-Golf in Germany) because they’re equipped with both an internal combustion engine and an electric powertrain, but the added ICE takes away the range anxiety that consumers may have with electric cars. For example, most buyers of the BMW i3 spend an extra € 4.500,- to get the optional range-extending gasoline engine. Sales of Plug-In Hybrids in Europe has surged almost 250% to 27.280 in the first nine months of 2014, up from 7.879 in the same period last year, compared to just over 38.500 EVs, which is up 50% from 25.700.

Renault is right to celebrate the milestone of its 50.000th EV, but electric cars still have a long way to go in Europe and the upcoming wave of Plug-In Hybrids isn’t helping the cause, especially since these cars score favorably in the NEDC fuel economy test, which helps them get government subsidies in several European countries, thus reducing their price premium. Even Renault-Nissan are forced to consider the development of Plug-In Hybrids, as Carlos Ghosn has admitted. However, he remains a firm believer that Zero Emission vehicles are the way to go in the long term.