The Volkswagen Group continues to dominate the European automobile market with a record 27% market share in July 2014 thanks to increasing sales of the Skoda and Seat brands, and on a much smaller scale Porsche. Its core VW brand meanwhile has taken a large chunk of market share from its direct competitors to position itself as the clear sales leader in Europe.

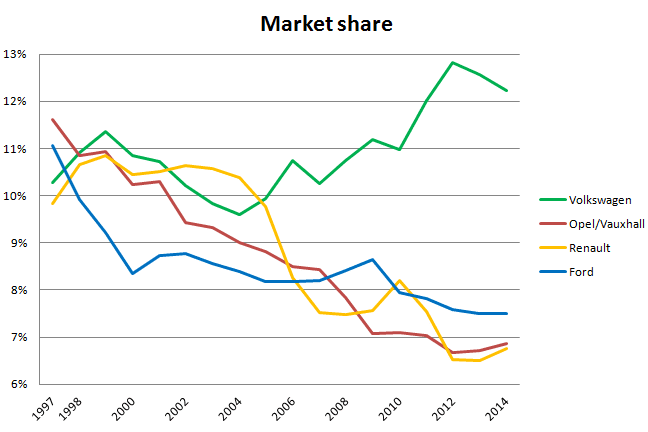

In the last decade, as the European passenger car market has slumped from a record high of just over 16 million units in 2004 to a record low of 12,27 million in 2013, sales of Volkswagen have shown very little effect from this crisis. VW brand sales in 2013 were just 9.000 less than in 2004, and as a result the brand’s market share has grown from a low of 9,59% in 2004 to a record 12,57% in 2013. This means that VW has positioned itself as the clear market leader in Europe, leaving its three closest competitors Ford, Opel/Vauxhall and Renault scrambling for second place, all at least five full percentage points below the German brand.

In contrast, from 1997 until 2001, the top three brands in Europe all had market shares above 10%, and when VW was Europe’s no. 1 brand from 1998 until 2001, it never had an advantage of more than half a percentage point over its nearest competitor.

Ford, Opel/Vauxhall and Renault each have set short- to mid-term goals of either reclaiming or maintaining a second place in the European brand charts, fully aware that’s the best they could hope for, as Volkswagen is too powerful to let any of them even come near. With its highly profitable dominant position in China, Volkswagen Group has got plenty of cash piled up to enable it to use heavy discounts in Europe, a strategy which has been criticized by Fiat-Chrysler CEO Sergio Marchionne for “creating a bloodbath” among brands that rely too heavily on the European market.

Ford, Opel/Vauxhall and Renault each have set short- to mid-term goals of either reclaiming or maintaining a second place in the European brand charts, fully aware that’s the best they could hope for, as Volkswagen is too powerful to let any of them even come near. With its highly profitable dominant position in China, Volkswagen Group has got plenty of cash piled up to enable it to use heavy discounts in Europe, a strategy which has been criticized by Fiat-Chrysler CEO Sergio Marchionne for “creating a bloodbath” among brands that rely too heavily on the European market.

Ford has been in second place since 2008, with only a minor interruption in 2010, while Opel/Vauxhall has lost almost half of its market share from 1997 to 2013 in a steady decline, and Renault has faced a steep decline especially between 2004 and 2007, when the French brand was pushed down from a clear first to a distant fourth place, a position it has held since 2012 when it dropped below GMs Opel/Vauxhall brands.

Renault recovery

Still, Renault may be best positioned to reach its goal of reclaiming the second place by leapfrogging both Ford and Opel/Vauxhall. With the exception of the Clio compact, Captur small crossover and recent Twingo minicar, the French currently have one of the oldest line-ups in the market, and replacements of core models in the next few years should help Renault recover some of its lost volume.

Still, Renault may be best positioned to reach its goal of reclaiming the second place by leapfrogging both Ford and Opel/Vauxhall. With the exception of the Clio compact, Captur small crossover and recent Twingo minicar, the French currently have one of the oldest line-ups in the market, and replacements of core models in the next few years should help Renault recover some of its lost volume.

The new Espace large MPV will debut at the Paris auto show next month, and its design will be a step away from the traditional minivan shape to look more like a crossover, as the large MPV segment is shrinking fast. But a bigger push in volume will come from the replacements of the aging Megane compact and Scenic midsized MPV, due by the end of 2015 or beginning 2016.

Renault is also planning a replacement to the slow-selling Samsung-built Koleos midsized SUV, which will be based on the very successful Nissan Qashqai. This crossover will help the French better compete with the VW Tiguan, Ford Kuga and the aging Opel/Vauxhall Antara. If this model manages to even sell half of the Qashqai’s 200.000 annual units, it would propel the Renault brand past Opel/Vauxhall and within arm’s length of Ford.

Renault is also planning a replacement to the slow-selling Samsung-built Koleos midsized SUV, which will be based on the very successful Nissan Qashqai. This crossover will help the French better compete with the VW Tiguan, Ford Kuga and the aging Opel/Vauxhall Antara. If this model manages to even sell half of the Qashqai’s 200.000 annual units, it would propel the Renault brand past Opel/Vauxhall and within arm’s length of Ford.

Also in the product pipeline is a replacement for the Laguna midsized car, a model whose second generation enjoyed great successes in 2001 and 2002, peaking at almost 250.000 annual units until reliability issues with electronics and turbochargers completely destroyed its reputation. The third generation Laguna has had very few reliability problems, but the reputation of the Laguna badge and the shift from mainstream to premium brands in the midsized segment have left Renault with less than 18.000 midsized sales in 2013, fewer than even the not very successful Volkswagen CC, the premium four-door coupe version of the Passat.

Ford’s lost focus

Meanwhile, Ford’s renewed Mondeo midsized car, which has seen sales tumble from above 300.000 in the late 1990’s to a mere 50.000 last year, will hit European showrooms next December. However, because Ford has moved production from Belgium to Spain, the Mondeo replacement (as well as those of Ford’s large MPVs Galaxy and S-Max) has taken longer than originally planned, and the design has already been on sale in the US as the Ford Fusion since 2012 and in China since last year. Whether European midsize buyers still consider the design fresh enough to buy and lease more than 100.000 Mondeo’s again has to be proven.

Meanwhile, Ford’s renewed Mondeo midsized car, which has seen sales tumble from above 300.000 in the late 1990’s to a mere 50.000 last year, will hit European showrooms next December. However, because Ford has moved production from Belgium to Spain, the Mondeo replacement (as well as those of Ford’s large MPVs Galaxy and S-Max) has taken longer than originally planned, and the design has already been on sale in the US as the Ford Fusion since 2012 and in China since last year. Whether European midsize buyers still consider the design fresh enough to buy and lease more than 100.000 Mondeo’s again has to be proven.

Of Ford’s core models, the Fiesta subcompact and Focus compact car have just received their mid-cycle facelifts, the Kuga midsized SUV is still fresh and the C-Max midsized MPV will be updated early next year. Sales of the two year old B-Max compact MPV are already slowing and the Ka minicar will be discontinued when the current second generation comes to the end of its life cycle. Ford may decide to import the low-budget Ka for South-American markets from Brazil, although that strategy has yet to prove successful, as VW has done the same with the slow-selling Fox minicar, which failed to reach the sales levels of its predecessor Lupo, let alone those of the current Up!. Moreover, the initial sales figures for the recently introduced Ford Ecosport compact crossover, which has also been developed primarily for developing markets, show that European consumers have higher standards when it comes to (interior) design and refinement.

Of Ford’s core models, the Fiesta subcompact and Focus compact car have just received their mid-cycle facelifts, the Kuga midsized SUV is still fresh and the C-Max midsized MPV will be updated early next year. Sales of the two year old B-Max compact MPV are already slowing and the Ka minicar will be discontinued when the current second generation comes to the end of its life cycle. Ford may decide to import the low-budget Ka for South-American markets from Brazil, although that strategy has yet to prove successful, as VW has done the same with the slow-selling Fox minicar, which failed to reach the sales levels of its predecessor Lupo, let alone those of the current Up!. Moreover, the initial sales figures for the recently introduced Ford Ecosport compact crossover, which has also been developed primarily for developing markets, show that European consumers have higher standards when it comes to (interior) design and refinement.

This may be one of Ford’s weakest spots: the brand’s still only a sideshow in one of Europe’s hottest segments: that of compact crossovers. Opel/Vauxhall and especially Renault are enjoying great successes with their Mokka and Captur respectively, while the Ecosport, as mentioned, is still selling at less than 10% of the volume of those models.  And Volkswagen isn’t even a player in that segment until the Up!-based Taigun is introduced sometime around 2016. New players from other volume brands are entering this segment every few months and each of them looks set to offer better value for money than the small Ford crossover.

And Volkswagen isn’t even a player in that segment until the Up!-based Taigun is introduced sometime around 2016. New players from other volume brands are entering this segment every few months and each of them looks set to offer better value for money than the small Ford crossover.

Opel/Vauxhall’s struggling operations

General Motors’ European division is still suffering from a lack of investment in new products and technology during the GM bankruptcy. The brands now face a drought of new products and are playing catch-up with the competition in fuel efficiency, one of the continent’s most important factors when buying a car these days, because of government incentives on fuel sipping vehicles.

And the departure of GMs budget Chevrolet brand hasn’t caused consumers to flock to Opel and Vauxhall as General Motors might have hoped. Perhaps the oncoming Opel Karl/Vauxhall Viva (the brand’s first model to have different names for each brand since 1996, when the Vauxhall Cavalier was renamed Vauxhall Vectra) as a replacement to the Agila minicar as the brands’ entry-level model next year can help retain some of the Chevrolet Spark and Aveo buyers.

And the departure of GMs budget Chevrolet brand hasn’t caused consumers to flock to Opel and Vauxhall as General Motors might have hoped. Perhaps the oncoming Opel Karl/Vauxhall Viva (the brand’s first model to have different names for each brand since 1996, when the Vauxhall Cavalier was renamed Vauxhall Vectra) as a replacement to the Agila minicar as the brands’ entry-level model next year can help retain some of the Chevrolet Spark and Aveo buyers.

The Astra compact has seen volumes collapse to less than half of what it sold as recent as 2007, when it outsold the Volkswagen Golf (in contrast: the Golf is selling almost triple the volume of the Astra in 2014), but a replacement is not due for another couple of years. Until then, the Mokka compact crossover has to make up for the lost volume.

The Astra compact has seen volumes collapse to less than half of what it sold as recent as 2007, when it outsold the Volkswagen Golf (in contrast: the Golf is selling almost triple the volume of the Astra in 2014), but a replacement is not due for another couple of years. Until then, the Mokka compact crossover has to make up for the lost volume.

The aging Corsa subcompact will be facelifted by the end of this year, although Opel/Vauxhall claim it’s an all-new generation, but it will be hard for the Corsa to keep up with the Ford Fiesta, Renault Clio and Volkswagen Polo, as the basics of the design and the platform will already be ten years old upon its introduction. As GM could only spend its limited R&D budget only once, it decided that the funky minicar Adam had a priority. This bet has proven successful so far, as the Adam is hitting sales targets, although it’s nowhere near the volume the Corsa is selling. Or even the Renault Twingo, for that matter.

The aging Corsa subcompact will be facelifted by the end of this year, although Opel/Vauxhall claim it’s an all-new generation, but it will be hard for the Corsa to keep up with the Ford Fiesta, Renault Clio and Volkswagen Polo, as the basics of the design and the platform will already be ten years old upon its introduction. As GM could only spend its limited R&D budget only once, it decided that the funky minicar Adam had a priority. This bet has proven successful so far, as the Adam is hitting sales targets, although it’s nowhere near the volume the Corsa is selling. Or even the Renault Twingo, for that matter.

Of GMs other core models, the Opel/Vauxhall Insignia midsized car, Meriva compact MPV and Zafira midsized MPV have all been facelifted in the past couple of years, and the low-volume Cascada convertible is only in its second full year of sales. Therefore I don’t expect General Motors’ European operations to rebound as quickly in the next couple of years as I think Renault will.

Volkswagen keeps its crown

As Volkswagen continues its strong performance in Europe’s core segments with the replacements to the Passat midsized car, Touran midsized MPV and Tiguan midsized crossover, while entering hot segments like the compact crossover segment with the Taigun and the EV market with the e-Up! and e-Golf, the brand is set to keep its share of the European car market at or above 12%.

It’s three main rivals continue to battle for second place, but I believe Renault is best positioned to reclaim the second place and perhaps reach the 10% share threshold for the first time since 2004, while Ford and General Motors’ Opel and Vauxhall brands may rebound slightly, but will struggle to hold on to or reclaim that second place they’re both aiming for.