BAIC’s electric vehicles are selling well in China. As recently as December 2018, three of China’s “top five” best selling EVs were BAIC vehicles according to one source. BAIC’s 2018 new EV product launches included both a small SUV, the EX360; as well as a sedan, the EU5. Both models are pictured below:

The EX360 has an after subsidy price of 79,900 RMB (equivalent to $11,846). Its range of 327 km. (203 miles) should be more than sufficient to satisfy the daily driving needs of most drivers. The battery has a capacity of 48 kWh and can be fast-charged, up to 80%, in 30 minutes. The EX360 has a maximum speed of 125 km/h (78 mph.), and a maximum torque of 230 Nm. Inside the vehicle are two screens including a LCD instrument screen (6.2 inches), and and a high definition touch screen (7 inches) which provides access to navigation systems and multimedia entertainment.

A phone APP allows the owner of the vehicle to remotely control or check a number of features, such as monitoring of the battery and its charge status, turning the air conditioning on before entering the vehicle, and similar additional convenience functions. The designers of the EX360 have built in a number of environmental or health related design aspects. These include air filtration and purification systems to address China’s air pollution challenges, and noise reduction and sound insulation technologies.

A phone APP allows the owner of the vehicle to remotely control or check a number of features, such as monitoring of the battery and its charge status, turning the air conditioning on before entering the vehicle, and similar additional convenience functions. The designers of the EX360 have built in a number of environmental or health related design aspects. These include air filtration and purification systems to address China’s air pollution challenges, and noise reduction and sound insulation technologies.

BAIC’s EU5 sedan (seen below), was also launched during 2018, and has an after subsidy price of 129,000 RMB (equivalent to $19,154). The sedan boasts a long range of 570 km. (354 miles), and is powered by a high performance ternary lithium battery. The battery has a capacity of 60.2 kWh, and an energy density of 151 Wh/kg. Two variants of the EU5 are available, a base model, and a higher end model that has a quick-charge capability (80% level in 30 minutes). The EU5 has a maximum speed of 155 km/h (96 mph.) and can accelerate from 0-100 km. in just under eight seconds.

The instrument control panel is 12.3 inches in size, with a flying screen which is capable of superimposing/draping  the viewed screen from the control panel to the driver’s dashboard display. This allows the driver to stay forwardly focused, and to avoid having to glance sideways which can make for distraction.

the viewed screen from the control panel to the driver’s dashboard display. This allows the driver to stay forwardly focused, and to avoid having to glance sideways which can make for distraction.

Other features which should appeal to many consumers, including younger buyers, are the EU5’s interactive voice control and the advanced driver assistance system (ADAS).

Interactive voice control,features include the ability to dictate and send an instant message, set and control the air conditioning, define travel routes/scenarios, etc. .

The EU5’s ADAS functions include adaptive cruise, lane departure warnings, and collision warnings pertaining to both vehicles and pedestrian safety.

EU5 sales in China have been strong. December 2018 sales volume reached 12,561 units/sold. The corresponding figure for the EX Series was 6,8441.

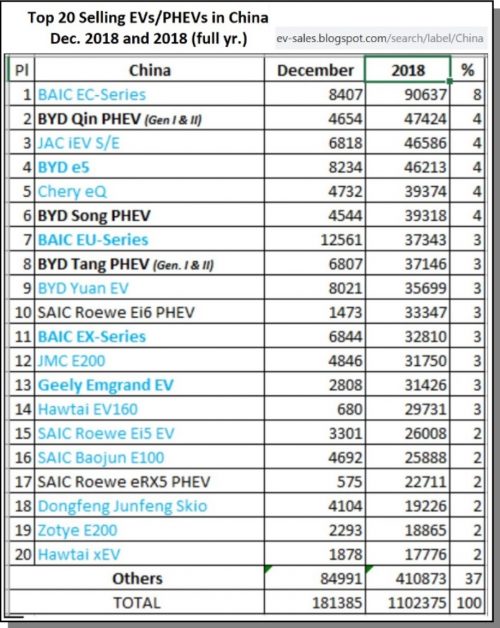

Two companies – – BAIC and BYD – – have been vying for the No.1 position in the Chinese market. According to a list ranking the 2018 Top Twenty Selling EVs in China, BAIC models ranked 1st, 7th, and 11th, and cumulatively accounted for 160,790 vehicles sold. The only company to outsell BAIC was BYD, which cumulatively sold 205,800 cars, and whose models occupied the 2nd, 4th, 6th, 8th, and 9th positions on the list. The full list appears below:

New Energy Vehicles/NEVs (i.e. EVs + PHEVs/Hybrids), have become a major force and priority, for BAIC overall. As one of China’s major automobile manufacturers, BAIC has a long established history of producing and selling conventional cars (i.e. cars powered by the Internal Combustion Engine/ICE). This is rapidly changing. To get a better feel for this change, it is interesting to compare BAIC’s 2018 EV sales with 2017. During 2018 BAIC’s EV sales volume was approximately 160,790 units sold, as compared to 101,351 for 2017. That change represents a 58% increase year-on-year (YoY), which by any standard, represents an impressive and rapid rate of growth for BAIC’s EV business. Overall, considering all vehicle types, BAIC sold fewer vehicles in 2018 as compared to the previous year.

Some industry analysts have questioned the wisdom or business case for BAIC’s strategic shift towards EVs. Yang Jian, the editor of Auto News China, a long established and well respected expert regarding China’s automobile industry, is one such analyst. In short, the logic and critique from Jian is as follows:

- Sales of NEVs in China remain highly dependent on government subsidies, and such subsidies are being reduced over time.

- Chinese consumers will not buy NEVs without such subsidies, and therefore the longer term viability/sustainability of China’s NEV push is highly questionable.

- Automobile manufacturers such as BAIC have been using profits generated from their traditional business (i.e. sales of ICEs) to subsidize the profit losing activities of their NEV business segments. This is unsustainable, and furthermore, it drains resources from business units that are profitable/sustainable, and redirects resources unwisely to units that are unprofitable/unsustainable.

While the jury is still very much “out” as to whether the strategy of companies like BAIC, whom would appear to be betting heavily on the success of China’s NEV future – – will ultimately pay off – – a number of other important factors have to be considered, these include:

- One reason that companies such as BAIC have had to subsidize their NEV business segments is that subsidies from China’s government are generally long delayed and unreliable. A review of BAIC’s 2018 Interim Report and related financial statements, as well as a review of 2018 corporate filings/disclosures on the Kong Kong Stock Exchange (HKEX), suggests that government subsidies remain unpaid and owed 3.

- Although subsidies are scheduled to end by the end of 2020, a carbon-credit trading system/market is currently being established in China. The system which is scheduled to begin this year (2019) is expected to be similar to ‘California’s Cap and Trade‘ system.China’s cap and trade system, will be the government’s and the PRC’s main policy tool and mechanism to incentivize the automobile industry’s transition from ICEs to NEVs.

- The success or failure of California’s system is debated and probably will not be known for some time (given its long term nature). A report here, by Next 10, an independent non-partisan organization, concluded in a January 2018 report that:

- “In March of 2012, California’s Governor Jerry Brown set a goal of putting 1.5 million zero-emission vehicles (ZEVs) on California’s roads by 2025. Today, California is well on its way toward reaching that goal.” An article here, might be of interest to readers, wishing to learn more.

Despite a decrease in government grants/subsidies, BAIC’s net profits have actually increased during the first nine months of 2018, the most recent reporting period. Net profit for Jan.-Sept. 2018 was 11.56B RMB ($1.71B), while net profit for the same months of 2017 was considerably lower at 8.48B RMB ($1.26B ).

Of critical importance is the fact that this increase in net profits has occurred during a period when BAIC as a company is transitioning from ICEs to NEVs. While it is too early to know whether BAIC’s strategic shift to NEVs is going to pay off, the increase in net profit coupled with BAIC’s publicly stated 2019 target of selling even more NEVs (BAIC Aims to Sell 220,000 Electric Vehicles) suggests a strong corporate commitment to electric vehicles and hybrids.

BAIC has set a goal of ending its production and sales of gasoline-powered vehicles by 2025. Its ambition has been set even higher for its sales operations in its home city of Beijing; where by 2020, it plans to sell only New Energy Vehicles. As a leader and major competitor in this segment of the industry, BAIC will continue to be an exciting company to watch.

For a complete list of sources and references used in this article; click here.

Full disclosure: I currently do not own shares in BAIC, BYD, or any other company mentioned in this article.

1 Different sources in the Chinese media report different sales volume figures for 2018 December monthly sales for the EU series and the EX series. For example the D1EV Ranking List from First Electric reports 12,159 “EU Series” sold in December, while the corresponding figure for the “EX Series” is 9,014.

2 At the time of publishing, full year results for 2018 were not yet available, thus 2018H1 is compared to 2017H1.

3 BAIC’s 2018 Interim Report includes financial statements with the line item “government grants” – – a line item that should incorporate/reflect government subsidies received in support of New Energy Vehicles (NEVs) if in fact, transfer of funds from the government to BAIC had occurred. A comparison of this line item for mid year 2018 (20180630) vs. mid year 2017 (20170630) shows a negative, and growing figure for government grants, suggesting that government subsidies owed to BAIC were actually rising for the period Jan.-Jun. 2018.